Income Tax - Sub-contract expenses, Royalty, Difference in Gross receipts - The assessee is a partnership firm engaged in the business of civil contracts, mainly of government departments and government undertakings. The Assessing Officer (AO) made additions to the assessee's income under sections 68, 69C and 115BBE of the Income Tax Act on account of unexplained sub-contract expenses, disallowance of royalty paid, and difference in gross receipts reported in the Profit and Loss account and TDS schedule - Whether the addition of Rs. 15,03,62,905/- made by the AO as unexplained cash credit under section 68 in respect of outstanding payable to sub-contractors is justified - HELD - Since the assessee had accepted the total sub-contract expenses of Rs. 38,46,99,507/- in the Profit and Loss account, and no defects were pointed out in the books of accounts maintained by the assessee, there was no justification for the AO to disallow the outstanding amount of Rs. 15,03,62,905/- declared as sub-contract expenses payable under section 68 as unexplained cash credit. The AO is directed to delete the entire addition of Rs. 15,03,62,905/- made under section 68 – The appeals of the assessee are allowed

Issue 2: Whether the disallowance of royalty expenses of Rs. 52,26,815/- claimed by the assessee is justified - HELD - The royalty paid by the assessee was an expense incurred wholly and exclusively for the contract work, as the civil works executed by the assessee as a contractor involved the use of minerals like sand, stones, extracted from quarries, gravel, metal on which the Government levied royalty. The Government department deducted the royalty on the material used in the works contracts at the stage of passing the bills of the contract work done and thereafter made the balance payment. Therefore, the amount deducted by the Government Department under the head royalty from the Gross contract Bill is an allowable expense, and accordingly allowed this ground of the assessee.

Issue 3: Whether the addition of Rs. 5,38,41,149/- made by the AO on account of difference in gross receipts on which TDS credit was claimed and the gross receipts reported in the Profit and Loss account is justified - HELD - The difference of Rs. 5,38,41,149/- was mainly due to the inclusion/exclusion of GST amount shown by the Government department/undertaking while deducting the TDS, and there was no suppression of income as alleged by the AO. Therefore, the AO is directed to delete this addition of Rs. 5,38,41,149/-.

2025-VIL-1636-ITAT-BLR

IN THE INCOME TAX APPELLATE TRIBUNAL

BANGALORE

ITA No. 1602/Bang/2025

Assessment Year: 2023-24

Date of Hearing: 09.10.2025

Date of Pronouncement: 11.11.2025

M/s NIKSHEP INFRA PROJECTS

Vs

THE INCOME TAX OFFICER

Appellant by: Shri Sukruth, CA

Respondent by: Shri Subramanian S., Jt. CIT(DR)(ITAT), Bengaluru

BEFORE

SHRI LAXMI PRASAD SAHU, ACCOUNTANT MEMBER

SHRI KESHAV DUBEY, JUDICIAL MEMBER

ORDER

Per Keshav Dubey, Judicial Member

This appeal of the assessee is arising out of the order of the ld. CIT(Appeals), National Faceless Appeal Centre, Delhi (NFAC) dated 01.07.2025 vide DIN & Order No. ITBA/NFAC/S/250/2025- 26/1078089036(1) passed under section 250 of the Income Tax Act, 1961 (in short “The Act”) and relates to assessment year 2023-24.

2. The assessee has raised the following grounds of Appeal-

“1) The order of the learned CIT(A) NFAC Delhi is arbitrary, against the provisions of law, Principles of Natural Justice and contrary to the facts of the case and is therefore unsustainable.

2). The learned CIT(A) erred in dismissing the appeal for nonprosecution without giving adequate opportunity to the Appellant.

3). The learned CIT(A) erred in dismissing the appeal for alleged non-prosecution in violation of provisions of section 250 of the I.T. Act.

4). The learned CIT(A) erred in not considering that the Assessing officer had made arbitrary addition of the amount payable to Sub-contractors of Rs. 15,03,62,905 as Unexplained Cash Credits U/s 68 without considering the details furnished by the Appellant and without giving adequate opportunity.

5). The Learned CIT(A) erred in not considering that the Assessing officer had arbitrarily disallowed Royalty on Minerals of Rs. 52,26,815 deducted by the Government Departments in their Bills without any basis and without considering the explanation, details and evidences furnished by the Appellant.

6). The Learned CIT(A) erred in not considering that the Assessing officer had arbitrarily made addition of difference in Gross Receipts on which TDS credit was claimed and the Gross receipts in P&L A/c of Rs. 5,38,41,149 without any basis, without, considering the detailed explanation and evidences submitted by the Appellant and without giving adequate opportunity to the Appellant.

7). For the grounds stated above and for the grounds which may be permitted to be adduced at the time of hearing of the appeal it is prayed that the addition made in the assessment order be deleted and justice rendered.”

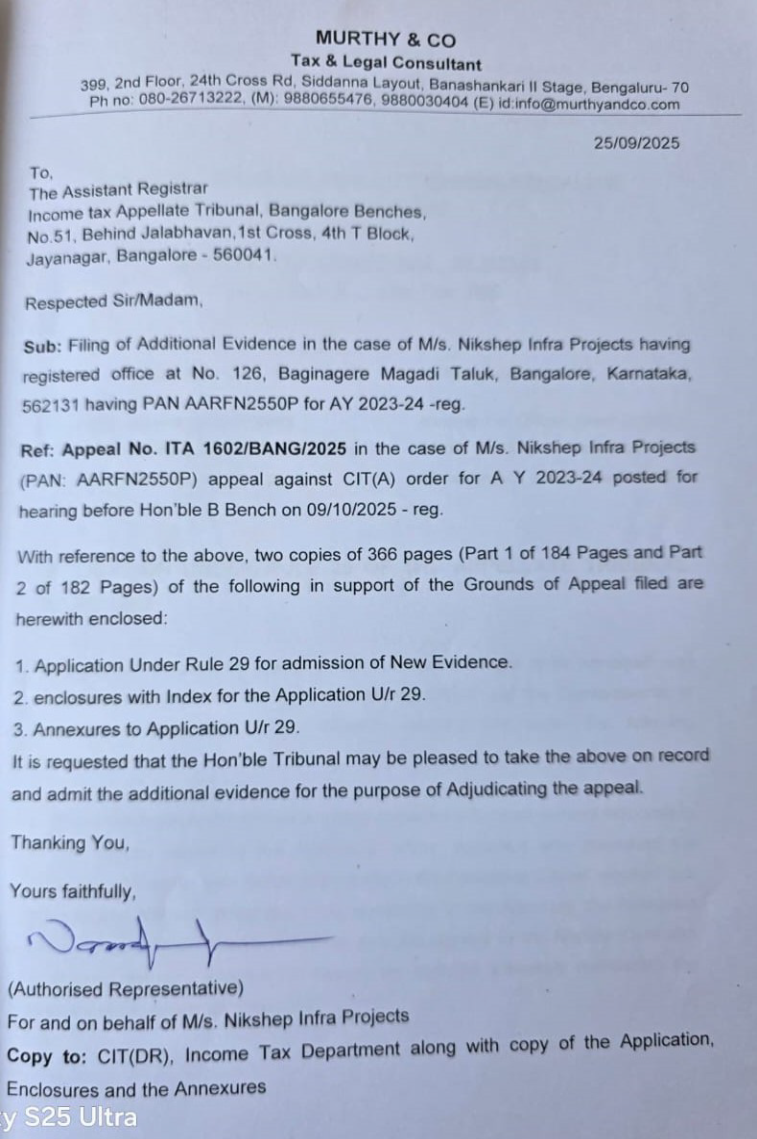

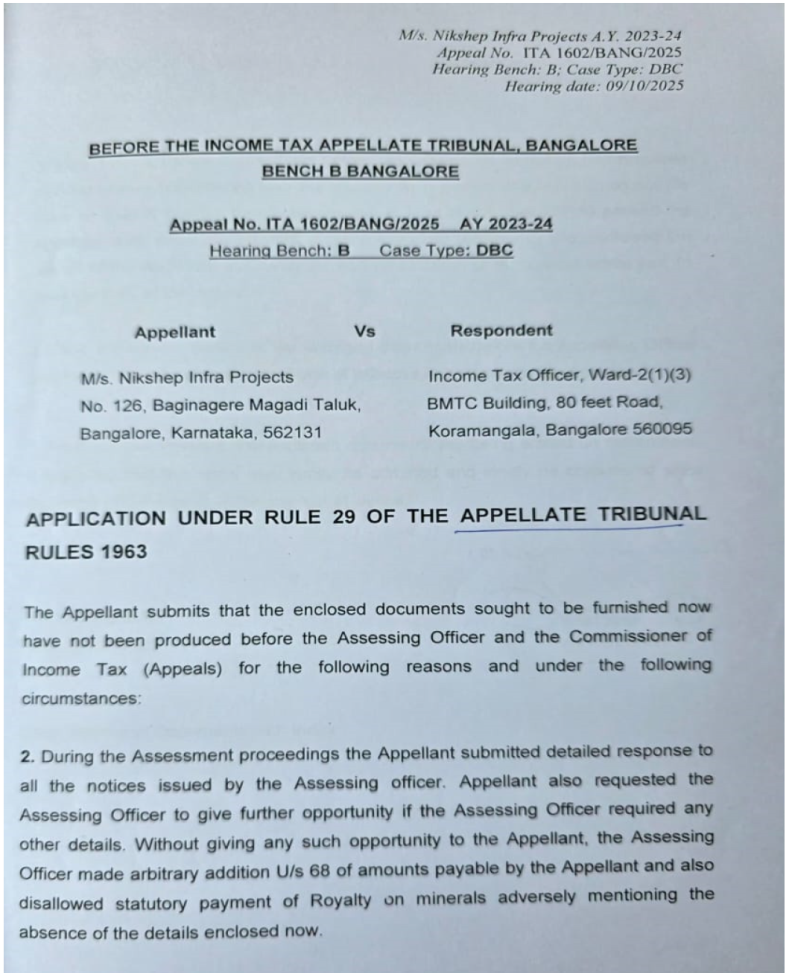

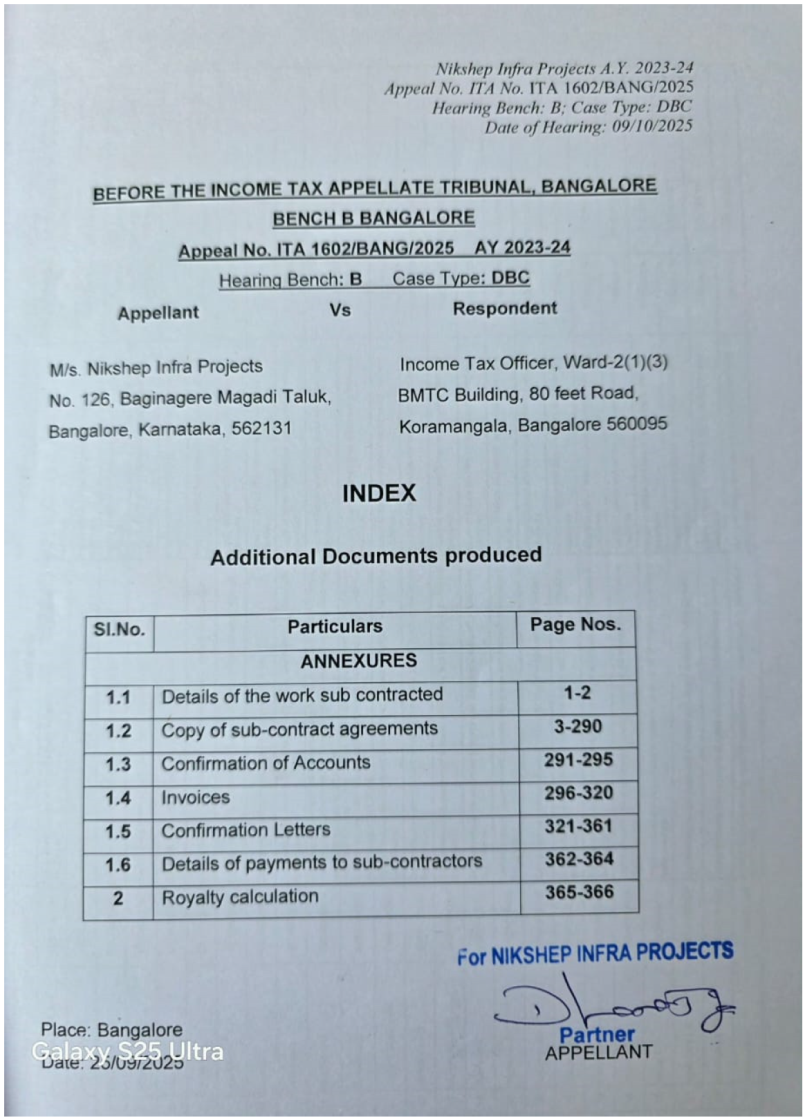

3. Before us, the assessee has filed an application for allowing the production of additional evidences as follows under Rule 29 of the Income Tax Rules:

3.1 The ld. A.R. submitted that before the Authorities below, the assessee was unable to produce these documents/evidences/details in support of its contentions due to lack of effective opportunity provided to the assessee. He submitted that the assessee is now seeking to produce the same before us by way of accompanying application for production of additional evidence. In view of this, he submitted that the Tribunal being the ultimate fact-finding authority, it is a fit case for the accompanying application to be allowed and the additional evidence to be admitted.

3.2 Further, the ld. AR of the assessee submitted that the documents filed along with accompanying application are essential for adjudication of the issues in the present appeal. He submitted that if the assessee is not allowed to produce the documents specified in the accompanying application as additional evidence on its behalf, it will be put to irreparable loss and injury. On the other hand, no loss or hardship will be caused to the respondent if this application is allowed. He therefore, most respectfully prayed that this Tribunal be pleased to allow the accompanying application and allow the assessee to produce the documents specified in the accompanying application as additional evidence on its behalf in the interest of justice and equity.

4. The ld. D.R. strongly opposed the admission of additional evidence at this stage.

5. We have heard the rival submissions and perused the materials available on record. On admission of additional evidence, we find good and sufficient reason in not producing/submitting these additional evidences on earlier occasions before the lower authorities. We also noted that the ld. CIT(A)/NFAC dismissed the appeal for non prosecution by the assessee. In our Opinion all the facts are already on record and there is no necessity of investigation of any fresh facts for the purpose of the adjudication of above evidences produced before us. Accordingly, we admit these additional evidences for adjudication. Further, the Hon’ble High Court of Orissa in the case of Siksha “O” Anusandhan v. Commissioner of Income-tax reported in (2011) 336 ITR 112 (Ori-HC) has held as under-

“23. Law is well-settled that once the materials are available on record, the appellate court should have disposed of the case on the merits taking those materials into consideration and there is no need to direct remand.

24. The Apex Court in Indian Bank v. K.S. Govindan Nair [2004] 13 SCC 697, held that once the materials are available on record, it was for the High Court to have decided the matter on the basis of that materials after appreciation of evidence, and there was no need for directing remand.

25. The Apex Court in Gowrammanni v. V.V. Patil (D) [2009] (II) OLR SC 465, held that the appellate court should have itself disposed of the case on the merits taking into consideration the evidence adduced before the trial court as on the question of identity of disputed land the parties have adduced evidence, the court commissioner was appointed and submitted a report, and he was examined as a witness and duly cross-examined and thereupon the suit was disposed of by the trial court.”

Respectfully following the decision of the Hon’ble High Court of Orissa, we are inclined to adjudicate the case on merits after considering the additional evidences and there is no need to direct for the remand.

6. Now the brief facts of the case are that the assessee is a Partnership firm & engaged in the business of Civil Contracts, mainly of the Government Departments and Government undertakings. The assessee firm filed its return of income for the assessment year 2023-24 u/s 139(1) of the Act on 28/10/2023 declaring total income of Rs. 7,44,40,600/-. Thereafter, the case of the assessee firm was selected under CASS for the reason being business purchase made by the assessee and no TDS deducted u/s 194Q and Non-compliance to Income Computation & disclosure Standards. Accordingly, the notice u/s 143(2) of the Act and notices u/s 142(1) of the Act along with Show cause notice were issued. The assessee in response to above notices submitted the written submission along with computation of income, ledger, details of other payable, details of purchases, copy of ITR, details of sales, contract certificates, Form 26AS, details of secured loans etc. The assessee vide its reply dated 07/01/2025 submitted the reconciliation of Form 26AS, contract receipts, royalty deducted, details of sales etc. Further, the assessee vide its reply dated 05/02/2025 submitted the detailed sheet of purchases along with ledger confirmation, name and PAN of the parties. Lastly, vide reply dated 04/03/2025, the assessee submitted details of sales ledger, details of unsecured loans, invoices of purchases of motor vehicles, loan taken etc. The assessee had also made an submission on 17/03/2025 in response to show cause notice & explained the case on the VC also.

6.1 During the course of the assessment proceedings, the AO issued notice dated 08/03/2025 & required the assessee to show cause as to why an amount of Rs.17,01,36,763/- declared as Sub-contract outstanding payable should not be treated as unexplained expenditure and taxed u/s 69C r.w.s. 115BBE of the Act as it could not be ascertained that payments were received by the sub-contractors or whether any services were rendered by the sub-contractors. Further, the AO directed to furnish their names and addresses, copy of their bills/invoices, details of site at which worked, copy of ITR, ledger accounts, Sub-contract agreements specifying the nature of services rendered by them.

6.2 The AO issued notices u/s 133(6) of the Act to 10 subcontractors through the verification unit, 3 of whom were registered in e-filing portal & 7 were not registered. The AO observed that one of the sub-contractors have acknowledged to have undertaken any subcontract work of the assessee. The assessee had merely submitted the ITRs and Form No.16A. As the assessee had not produced any evidence with regard to these sub-contractors having undertaken any work, accordingly the total amount of sub-contract charges paid to 10 subcontractors aggregating to Rs 2,10,81,600/- was treated as bogus and added to income as unexplained credit u/s 68 r.w.s. 115BBE of the Act.

6.3 From the submission as made by the assessee, the AO noticed that further 10 sub-contractors had recently filed the ITRs as on 10/03/2025 i.e. at the behest of the assessee. As the assessee also failed to establish that these sub-contractors had carried out any genuine works, accordingly the AO treated the sub-contracting charges paid amounting to Rs. 1,67,40,900/- as bogus & disallowed u/s 68 r.w.s. 115BBE of the Act.

6.4 With regard to other 24 sub-contractors, the AO observed that the assessee failed to provide any evidence i.e. ledger confirmation, nature of contract, agreement, bills/invoices etc to prove that the work was done by the parties. Therefore, in the absence of documentary evidence Rs.11,25,40,405/- was treated as unexplained credit u/s 68 r.w.s. 115BBE of the Act. Thus, the AO added total of Rs.15,03,62,905/- [2,10,81,600 + 1,67,40,900 + 11,25,40,405 ] as unexplained credit u/s 68 of the Act.

6.5 During the course of assessment proceedings, it was also noticed by the AO that the assessee had made royalty payments of Rs.52,26,815/-. Before the AO, the assessee submitted that the royalty is directly deducted by the respective Government entity in accordance with the terms of the agreement. The AO observed that the assessee merely submitted the contract receipt and no other document was submitted. As the assessee failed to provide the basis of working out the royalty and the copies of agreement with the different entities, the royalty expenses claimed of Rs.52,26,815/- was disallowed and added to the total income of the assessee for the year under consideration.

6.6 Further, on going through the Profit & Loss Account, it was noticed by the AO that the assessee had declared total sales revenue of Rs.90,14,42,334/-. The assessee was requested to reconcile the sales with those appearing in form no.26AS. In this regard, the assessee merely submitted the receipt as appearing in form no.26AS and as reported in the gross sales and no reasons for the difference between the two have been provided. The AO noted that the assessee had offered gross sales of Rs.90,14,42,334/-, whereas TDS credit was claimed on a total gross receipts of Rs.95,52,83,483/-. The assessee however in its reply submitted that the difference was due to the inclusion/exclusion of GST amount shown by the contractor while deducting TDS and wrongly reported the total amount of Turnover. As the assessee only submitted an excel sheet showing the difference of receipts as per the books and receipt as per TDS schedule and no other documentary evidence or confirmation has been submitted by the assessee, the AO treated the entire difference amount of Rs.5,38,41,149/- as income of the assessee for the year under consideration.

6.7 Accordingly, the AO completed the assessment proceedings on a total assessed income of Rs.28,38,71,469/- while passing order u/s 143(3) r.w.s. 144B of the Act dated 24.3.2025.

7. Aggrieved by the assessment completed u/s 143(3) of the Act dated 24.3.2025, the assessee firm preferred an appeal before the ld. CIT(A)/NFAC.

8. The ld. CIT(A)/NFAC dismissed the appeal of the assessee by observing as below:

“ 6. Therefore, as the appellant has not pursued the appeal despite being granted several opportunities, this appeal is being decided on the basis of facts available on record.

7. During the course of appellate proceedings, no reply has been filed by the appellant. I have perused the order of the Assessing Officer and considered the facts of the case. The Assessing Officer has passed a speaking order with detailed discussion on the issues involved therein. The appellant has not pursued the appeal despite being granted several opportunities through notices u/s 250 of the I.T. Act. No details, documents or submissions have been provided by the appellant substantiating its grounds of appeal. Moreover, mere facts mentioned in Form No. 35 cannot be considered in the absence of any supporting documentary evidence and submissions.

The AO has passed a reasoned and speaking order considering all the facts and the circumstances of the case. Also, the appellant has failed to bring anything on record to support its grounds of appeal and to counter the additions made by the AO. Therefore, there is no reason to interfere with the order passed by the AO. Hence, the appeal filed by the appellant is dismissed.

8. In result, the appeal filed by the appellant is dismissed.”

9. Again being aggrieved by the order of the ld. CIT(A)/NFAC, the assessee firm has filed the present appeal before this Tribunal. The assessee has also filed 5 nos. of paper books in support of its case along with the case laws relied upon by the assessee.

10. Before us, the ld. A.R. of the assessee vehemently submitted that the assessee out of the total contract receipts of Rs.90,14,42,334/-, had sub-contracted the work to the sub-contractors amounting to Rs.38,46,99,507/-. Further, the ld. A.R. submitted that the assessee’s books of accounts are audited by a CA and no fault has been pointed out either by the auditor or by the AO. The show cause notice issued by the AO during the course of assessment proceedings was with regard to unexplained expenditure u/s 69C of the Act, however, the AO inexplicably added the same u/s 68 of the Act i.e. under unexplained credit. Lastly, the ld. A.R. submitted that the AO without doubting the genuineness of the sub-contract expenditure debited to profit & loss account treated the outstanding payable to sub-contractor amounting to Rs.15,03,62,905/- as unexplained cash credit u/s 68 of the Act. Further, with regard to disallowance of royalty paid, the ld. A.R. of the assessee vehemently submitted that the evidences and details were furnished with regard to royalty/LR deducted by the government department in their bills and the AO had arbitrarily disallowed the royalty amounting to Rs.52,26,815/- without any basis. Lastly, with regard to addition on account of difference in gross receipt as declared by the assessee and as reflected in form 26AS, the ld. A.R. of the assessee vehemently submitted that the detailed explanation along with evidences were filed before the AO along with reconciliation statement. The difference was due to the inclusion/exclusion of the GST by the Government entities which were duly reconciled and therefore, the AO has arbitrarily added the same as income of the assessee.

11. The ld. D.R. on the other hand vehemently relied on the order of the authorities below and submitted that the assessee could not submit the full details/evidences before the AO to substantiate its claim. Further, the assessee did not appear and avail the opportunity before the ld. CIT(A)/NFAC, which shows that the assessee is very callous in its approach before both the authorities and accordingly prayed that the appeal may be dismissed.

12. We have heard the rival submissions and perused the materials available on record. It is an undisputed fact that the assessee firm is engaged in civil contracts mainly of the government departments and government undertakings. During the year under consideration, out of the total contract receipts of Rs.90,14,42,334.40, works for Rs.38,46,99,507.73 were sub-contracted by the assessee to the various sub-contractors. The AO had made an addition of Rs.15,03,62,905/- towards the outstanding amount payable to sub-contractors as unexplained cash credit u/s 68 of the Act. It is submitted before us that there were 55 sub-contractors based on the nature of contracts, time available for completion, etc. Out of the total sub-contracted work of Rs. Rs.38,46,99,507.73, sub-contract works of Rs.33,07,81,785/- was to the sub-contractors having registration under GST Act and these sub-contractors have also filed GST returns in which the sub-contract amount were declared by them. The balance sub-contract work were given to the sub-contractors for value less than Rs.20 lakhs each. The details of sub-contractors i.e. name, PAN , GSTN No., amount shown in GSTR2B filed by them, opening balance, debit and credit entries during the year, closing balance and TDS made were produced before the AO. We take a note of the fact that the total outstanding amount payable to sub-contractor as on 31.3.2023 was Rs.17,01,36,763/- out of which the AO treated Rs.15,03,62,905/- [2,10,81,600 + 1,67,40,900 + 11,25,40,405 ] as unexplained credit u/s 68 of the Act. We also take a note of the fact that total sub-contract outstanding payable was Rs.17,01,36,763/- for the work done by them is not an expenditure incurred by the assessee but the outstanding amount payable to the subcontractors as on 31/03/2023 declared under the head “Other Payables” under the Current Liabilities. We are surprised to note that the AO proposed in the show cause notice dated 08/03/2025 to make addition under head unexplained expenditure u/s 69C of the Act amounting to Rs. 17,01,36,763/- being the amount payable to sub-contractors, however, in the Assessment order, the AO made addition u/s 68 of the Act as unexplained cash credits. We found that the AO right from the outset was mystified & make contradictory observations while passing the assessment order. The AO on one hand issued notices u/s 133(6) of the Act to the parties shown as “other Payables” & on the other hand observed that in order to verify the genuineness of the payment made to these sub-contractors aggregating to Rs.17,01,36,763/-, the notice u/s 133(6) was issued. We could not understand when the assessee itself is declaring the outstanding amount payables to the sub-contractors, then how the AO will verify the genuineness of payments of these outstanding amount which were not paid. Therefore, we are of the considered opinion that the AO himself was confused whether to disallow the expenditure of sub-contract expenses or to is disallow the amount payable at the yearend shown as liability by the assessee. The assessee maintains books of accounts on day to day basis. Further, the books of accounts of the assessee was also audited u/s 44AB of the Act by a CA. Neither the auditor nor the AO found any fault in the books of accounts of the assessee. The books of accounts were also not rejected by the AO u/s 145(3) of the Act. The AO had neither disputed the amount of sub-contract expenses debited to profit & loss account by the assessee nor find it bogus. The AO had also not disputed the gross receipts as made as well as the total purchases as declared by the assessee in the P&L account. Before us, the assessee by way of additional evidences had also produced the details of the work sub contracted along with sub-contract agreements, confirmation of accounts, Copies of the invoices raised by the sub contractors, details of payment to sub contractors & the amount outstanding which were perused. The assessee also submitted the details of payment of these outstanding amount of sub-contractors during the subsequent years along with the reconciliation statement by bifurcating the Opening balances, Actual work conducted, Payment received, Amount of TDS along with the closing amount payables. We are of the firm opinion that when the AO had accepted the expenditure of Rs.38,46,99,507.73 towards the sub-contract expenses debited to P&L account, then there is no question of disallowing the payables of the same.

12.1 In the light of above discussions and considering the totality of the facts of the case, we are of the considered opinion that as the AO had accepted the total sub-contract expenses of Rs.38,46,99,507/- as debited to profit & loss account & no defects had been pointed out in the books of accounts maintained by the assessee, we find no reason to disallow the outstanding amount of Rs.15,03,62,905/- declared as subcontract expenses payable u/s 68 of the Act as unexplained cash credit and accordingly we direct the AO to delete the entire addition of Rs. 15,03,62,905/- as made u/s 68 of the Act. Thus, this ground of appeal of the assessee is allowed.

13. Further, with regard to disallowance of royalty paid amounting to Rs.52,26,815/-, we are of the considered opinion that the civil works executed by the assessee as a contractor involve use of minerals like sand, stones, extracted from quarries, gravel, metal on which the Government levied royalty. The royalty rate prescribed for different items & the basis of working out the royalty along with the copy of agreement with different parties were also submitted before us which was the main contention of the AO in disallowing the royalty expenses. The Government Department for whom the contracts were accepted by the assessee deducted the royalty on the material used in the works contracts at the stage of passing the bills of the contract work done and thereafter they make the balance payment of the bills. We are of the considered opinion that the royalty is an expense for a contract work and is part of the contract cost. On going through the paper book submitted before us, we take note of the fact that the assessee had credited the Gross contract receipts as per the bills to the profit & loss account and accordingly claimed royalty as expenses debited to profit & loss account. We also take a note of the fact that assessee had also submitted contract certificates, ledger extract of the royalty payables party wise and ledger extract of royalty expenses. We are of the considered opinion that the amount deducted by the Government Department under the head royalty from the Gross contract Bill is an expenses incurred wholly & exclusively for the contract work and accordingly allowable as expenses. Accordingly, this ground of the assessee is also allowed.

14. Now with regard to addition of difference in gross receipts on which TDS credit was claimed and the gross receipts as declared in profit & loss account amounting to Rs.5,38,40,149/-, the assessee by way of paper book submitted the detailed reconciliation of total receipts as per 26AS & total Gross receipts as per P & L A/c. Further, the assessee has also submitted the reconciliation for difference between Gross Contract Receipts as per P & L a/c and receipts on which tax deducted at source.( Placed at PB-1). On going through the same we take note of the fact that the total receipts as per 26AS is Rs.90,68,92,756.11/- whereas the gross contract receipts offered in the profit & loss account is Rs.90,14,42,334.40/-. However, it is noticed that as per the TDS schedule of the return of income, the total gross receipts were Rs.95,52,83,482.75/-. & accordingly there is a difference of Rs. 5,38,41,148.32. During the course of assessment proceedings, the assessee submitted the reconciliation of the figures and also submitted that difference was not on account of any omission of taxable receipt and hence cannot be added as income of the assessee. The assessee further submitted that the main reason for the difference was due to inclusion/exclusion of GST by the parties who have issued TDS certificate but either not filed or not correctly filed the TDS returns. The assessee had declared the Gross contract receipts correctly in the profit & loss account and claimed the TDS credit also correctly in TDS schedule of the Return. Before us, the assessee by submitting the reconciliation statement has explained the reason of difference in gross receipts as declared in the profit & loss account and the gross receipt as declared in TDS schedule and we find that the difference was mainly due to the inclusion/exclusion of GST amount shown by the Government department/undertaking while deducting the TDS. We also take note of the fact that there were few wrong declaration of the turnover as well as under reporting of the turnover which were duly reconciled by the assessee and there is no suppression of income as alleged by the AO and accordingly we direct the AO to delete this addition of Rs. 5,38,41,149/-. Thus, this ground of appeal of the assessee is also allowed.

15. In the result, appeal filed by the assessee is allowed.

Pronounced in the open court on this 11th day of November, 2025.

DISCLAIMER: Though all efforts have been made to reproduce the order accurately and correctly however the access, usage and circulation is subject to the condition that publisher is not responsible/liable for any loss or damage caused to anyone due to any mistake/error/omissions.