Income Tax - Transfer Pricing, Arm's Length Price, Valuation, Intra-Group Services, R&D Services - The assessee is engaged in the business of providing integrated security solutions in India. During the assessment proceedings, the Assessing Officer (AO) made certain Transfer Pricing adjustments to the Arm's Length Price (ALP) of the assessee's international transactions, which were upheld by the Dispute Resolution Panel (DRP) - Whether the reference made by the Technical Unit to the Transfer Pricing Officer (TPO) for determination of the ALP was valid and the assessment proceedings were not time-barred – HELD - The assessee’s contentions is dismissed and held that the reference made by the Technical Unit to the TPO was valid and in accordance with the provisions of the Income-tax Act, 1961. Also, the assessment proceedings were not time-barred – The appeal of the assessee is partly allowed

Issue 2: Whether the AO was correct in rejecting the valuation report submitted by the assessee for the transfer of specified assets and substituting the actual revenue figures instead of the projections used by the assessee – HELD – The assessee's grounds were allowed and held that the AO cannot replace the projected figures used by the assessee in the valuation report with actual figures, as the valuation is based on projections and not actual figures. Relying on the decision of the Delhi High Court in the case of PCIT vs. Cinestaan Entertainment Pvt. Ltd., wherein it was held that the valuation cannot be done with arithmetic precision and the AO cannot challenge the valuation on the ground that the performance did not match the projections.

Issue 3: Whether the AO was correct in treating the value of intra-group services availed by the assessee as Nil – HELD - The issue is remanded back to the file of the AO/TPO to determine the proper ALP of the intra-group services by adopting the Most Appropriate Method and giving a proper opportunity of being heard to the assessee - The assessee had availed certain services from its Associated Enterprises for the implementation of turnkey projects, and the ALP cannot be Nil, as determined by the lower authorities.

Issue 4: Whether the AO was correct in rejecting the assessee's benchmarking of the R&D services and substituting it with his own set of comparables – HELD - The issue is remanded back to the file of the AO/TPO to redo the assessment of the TP adjustment after proper analysis of the Functional, Asset, and Risk (FAR) analysis and to redo the ALP afresh by selecting proper comparables as per the FAR analysis, after giving a proper opportunity of being heard to the assessee.

Issue 5: Whether the AO was correct in rejecting the Resale Price Method (RPM) adopted by the assessee for benchmarking the purchase of security and surveillance goods and adopting the Transactional Net Margin Method (TNMM) at the entity level - HELD - The issue is remanded back to the file of the AO/TPO to redo the benchmarking by adopting the proper method, i.e., RPM or TNMM relevant to the transactions under consideration, after giving a proper opportunity of being heard to the assessee.

2025-VIL-1613-ITAT-DEL

IN THE INCOME TAX APPELLATE TRIBUNAL

NEW DELHI

ITA No. 2321/DEL/2022

Assessment Year: 2018-19

Date of Hearing: 12.08.2025

Date of Pronouncement: 10.11.2025

ECOENERGY INSIGHTS LTD

Vs

DCIT

Assessee by: Shri Nageshwar Rao, Advocate, Shri Parth, Advocate, Shri Pratik Rath, Advocate

Revenue by: Shri S.K. Jadhav, CIT DR

BEFORE

SHRI S. RIFAUR RAHMAN, ACCOUNTANT MEMBER

SHRI ANUBHAV SHARMA, JUDICIAL MEMBER

ORDER

PER S. RIFAUR RAHMAN, ACCOUNTANT MEMBER:

1. This appeal preferred by the assessees is directed against the assessment order dated 25.07.2022passed by the Assessment Unit, Income Tax Department under section 147 read with section 144C(13) r.w.s. 144B of the Income-tax Act, 1961 (for short ‘the Act”) for AY 2018-19 pursuant to the directions of the Dispute Resolution Panel u/s 144C(5) of the Act.

2. Brief facts of the case are, assessee revised the return of income for the AY 2018-19 on 29.03.2019 declaring total income of Rs.Nil. The said return of income was selected for scrutiny through CASS. On selection of the case of scrutiny, notices u/s 143(2) and 142(1) of the Act along with questionnaire were issued and served on the assessee. In response, ld. AR of the assessee submitted the relevant information.

3. The assessee is a part of UTC Group and is in the business of providing integrated security solutions for the last 28 years in India. During assessment proceedings, the AO observed from the books of account and financial records that assessee has undertaken international transactions. In view of the above, reference u/s 92CA (1) of the Act after obtaining approval from the competent authority was made to the TPO. The TPO on reference, issued notice u/s 92CA of the Act and observed that the assessee has reported following international transactions in the form 3CEB: -

|

Sl. No. |

Nature of transaction |

Method applied |

Amount (INR) |

|

1 |

Purchase of electric security equipment/systems |

RPM |

82495380 |

|

2 |

Availing of support services |

TNMM |

267389174 |

|

3 |

Receipt of Subvention income |

TNMM |

95166149 |

|

4 |

Receipt of R&D Fee |

TNMM |

13433968 |

|

5 |

Transfer of specified assets |

Other Method |

4080690624 |

|

6 |

Recovery of expenses from ALC |

Other Method |

49015956 |

|

7 |

Reimbursements of expenses to carrier Corp. |

Other Method |

12566281 |

|

8 |

Guarantee Commission |

Other Method |

0 |

|

TOTAL |

4600756532 |

||

4. After considering the TP study submitted by the assessee, the TPO applied various filters to benchmark each international transactions and proposed following TP adjustments: -

|

Sl. No. |

Particulars |

Amount |

|

1. |

Purchase of goods |

2,56,08,980 |

|

2. |

Transfer of specified assets |

39,00,60,000 |

|

3. |

Receipt of R&D fee |

8,82,671 |

|

4. |

Availing of Support Services |

26,73,89,174 |

|

|

Total |

68,39,40,825 |

5. Aggrieved assessee filed objections before the DRP and raised various objections. With regard to objections relating to adjustment in respect of transfer of specified assets, ld. DRP observed as under: -

“3.2.2 The Panel has considered the submission, which is only a reiteration of the submission before the TPO and which has been considered at length by the TPO in para 9 of his order and rejected. The TPO has recorded that he required the assessee to submit the primary two details listed below:

1. Actual values of sales vis-a-vis projections used in the show-cause notice: and

2. Back-up of additional risk premium considered in the valuation report.

3.2.3 In its reply, the Assessee, however, did not provide the actual sales value in spite of specifically being asked for. Instead of filing the details before the TPO, it merely pleaded that the projections used in the valuation report be accepted, without any analysis or consideration. The TPO has rightly held that while preparing a valuation report, the projections are invariably provided by the respective company and it is generally not the responsibility of the valuer to vouch for these projections. Further, even the valuer has mentioned in the report that the financial projections have been provided by the management only. The Panel agrees with the contention of the TPO that the most logical way to verify the correctness or reasonableness of projections is to compare it with the actual values and then work backwards to analyze whether the future business results were reasonably predicted. But by not providing any details of actual business results, it thwarted the efforts of the TPO.

3.2.4 In respect of additional risk premium, the TPO required the assessee submit the back-up details of considering 12% risk premium. In the valuation report, two separate risk premiums were considered for 6% each. In respect of the second risk premium, the only justification provided is that it is based on the understanding of the market risk premium by the consultant. However, the valuation of such a big transaction cannot be done only on the whims and fancies of a particular consultant. There should be sufficient reasoning before choosing a particular value. The TPO also asked the Assessee to recalculate the valuation using the risk premium mention in the show-cause notice. The TPO has noted in para 9.4 or his order that even this was not done and that there was deliberate withholding of the relevant details from the TPO which prevented him to verify the valuation methodology used for determining value of transferred assets The TPO, therefore, rightly rejected the valuation study submitted by the assessee. The Panel, therefore, finds no infirmity in the order of the TPO.”

6. With regard to addition in relation to availing of support services, after considering the detailed submissions of the assessee, ld. DRP sustained the adjustments proposed by the TPO by observing as under :-

“3.3.2 The Panel has considered the submission. It is noticed that the arguments taken before the Panel have already been dealt with by the TPO. The Panel agrees with the view of the TPO that in order to examine the arm's length price of intra group services received by one of the associated enterprises following essential information should be available :

1. Whether the assessee has received intra group services?

2. What are the economic and commercial benefits derived by the recipient of intra group services?

3. In order to identify the charges relating to services, there should be a mechanism. in place which can identify (i) the cost incurred by the AE in providing the intra group services and (ii) the basis of all allocation of cost to various AEs.

4. Whether a comparable independent enterprise would have paid for the services incomparable circumstances?

3.3.3 Thus, the TPO has recorded from the details available that the taxpayer has not been able to prove that he has actually received services of some value that call for cost allocation. The issue regarding intra group payments among related party transactions has attracted attention of all the tax jurisdictions across the globe. Such payments being between related parties need much closer and deeper examination. These cannot be examined merely in the light of provisions contained in 37of the Act but also have to be examined under the special provisions contained in chapter X of the Act. The following are the crucial issues to be seen in such related party transactions :

a. The taxpayer's agreement with the associated enterprises related to intra group services is to be examined to see as to what kind of services were to be provided by the AE to the taxpayer As normally such agreements refer to a large number o services which could be rendered by the AE, the taxpayer has to specify the service(s) which is actually received by it for which the payment is made.

b. Whether the taxpayer really needed such services or not. if so, what direct or tangible benefit it has derived.

c. Contemporaneous information on the basis of which rate or payment for the service is determined. This includes the cost benefit analysis done by the taxpayer at the time of entering into agreement. Whether any benchmarking analysis was done by the taxpayer so as to compare the amount which he would have paid to an independent person under similar circumstances.

d. Whether an independent person would have paid such amount in comparable circumstances

e. Whether the expected benefit commensurate with the payment

f. Whether the taxpayer has separately incurred any expenditure on similar services and if so the necessity of making further payment to the AE or the same activity or it is a duplicate payment.

g. Whether the payment is in the nature of shareholder's activity or largely for the benefit of the AE.

h. Whether the AE is rendering such services to other AEs or independent parties and if so the rate / amount charged from such persons.

i. The cost incurred by the AE for providing such services and the basis of allocation key

j. If the AE has charged any mark-up on such payments the arm's length margin is also examined.

3.3.4 Thus, the TPO has righty concluded that the assessee could not show that the above-mentioned criteria were fulfilled. The taxpayer has not been able to show as to when and how the various services were requisitioned from the AEs, whether the services were actually needed by it, whether the same were actually received by it by producing contemporaneous documentary evidence at the time of entering into agreement: or at the time of availing the service (if actually availed) what benchmarking analysis was done. In an arm's length situation, before availing any service, an independent person would consider the nature of services required by it and would make the payment which commensurate with the nature of the service and the expected benefit derived there from. The facts of the case clearly show that whether or not the taxpayer needed these services or whether or not such services were mainly for its direct benefit or whether or not such services were actually availed by it, the taxpayer had to share the costs on the basis of some allocation keys. No independent: person in similar circumstances would pay such amount. These are clearly shareholders services, without any basis other than the fact that the taxpayer is part of a group and these expenses have been allocated to it. The Panel, therefore, upholds these findings of the TPO. Even in the remand report, the TPO has recorded that the additional evidence do not demonstrate any cost benefit analysis or any economic or commercial benefits. The Panel, therefore, finds no reasons to interfere with the order of the TPO.

7. With regard to R&D fees, DRP sustained benchmark made by the TPO, however, granted working capital adjustment by observing as under:-

“3.4.2 The Panel has considered the submission. The TPO has considered these contentions which are raised before The Panel. He has rejected the assessee's benchmarking because the set of comparables taken by the assessee is similar to the set of comparables taken by the assessee for benchmarking of Provision for Software services. Further on Perusal of the Business Description of the comparables it is observed that the company comparables taken by the assessee belongs to the software industry and, thus, cannot be accepted for benchmarking the Transaction of R&D Services. He accordingly conducted a fresh search on ACE TP and Prowess to benchmark the provision of R&D services. He has explained in para 3.2 of order that he considered the following filters besides the accepted one to zero-i. on final set of comparables for selecting suitable and functionally similar comparables to that of the tested party so as to benchmark tae international transaction. The Panel is of the view that the benchmarking has been done correctly and no inter-reference is called for. The TPO, however, shall grant working capital adjustment, if relevant data and detailed working were given to him during TP proceedings. The TPO did not find anything relevant in the set of additional evidence in his remand report.”

8. With regard to additions proposed on the issue of purchase of security and surveillance goods, after considering the submissions of the assessee, DRP sustained the proposed additions by observing as under:-

“3.5.2 The Panel has considered the submission. The arguments made here are just repetition of the contention raised before the TPC. It is noticed that the TPO has given adequate reasons in his TP order for accepting RPM which he has reiterated in para 6.2 of his order. He has also spelt out detailed reasons for exclusion of Costs pertaining to EcoEnergy division acquired during the year from Wipro. Thus, Panel find no reason to interfere with the order of the TPO. The TPO, however, shall grant working capital adjustment, if relevant data and detailed working were given to him during TP proceedings. Even in the remand report, the TPO has rightly intimated no worthwhile evidence has been furbished on any count.”

9. Aggrieved with the above order, assessee is in appeal before us raising following grounds of appeal:-

“Ecoenergy insights Limited (formerly Chubb Alba Control System Private Limited) (hereinafter referred to as 'Ecoenergy Insights' or Appellant') craves leave to prefer an appeal against the order passed by the Assessment Unit, Income Tax Department hereinafter referred to as "AU or "AO"] pursuant to direction issued by the Hon'ble Dispute Resolution Panel [hereinafter referred to as DRP] under Section 143(3) read with Section 144C(03) and Section 1448 of the Income-tax Act, 1961 (hereinafter referred to as the 'Act') on the following grounds :

1. On the facts and circumstances of the case, the final assessment order is bad in law ad void as it does not conform to binding directions of ld. DRP.

2. On facts and circumstances of the case and in law, the final assessment order is invalid as the same has been passed and served upon the appellant by the AU instead of the National Faceless Assessment Centre (NFAC), in violation of statutory procedure under Section 144B(1) and Section 144B(5) of the Act. Thus, the assessment proceedings are vitiated in law and liable to be quashed.

Grounds against addition proposed in relation to transfer of specified asset

3. That on the facts and circumstances of the case and in law, the impugned order is bad in law as the adjustment made in relation to transfer of specified asset in complete violation of instruction no. 5/2011 dated 30 March 2011 issued by the Central Board of Direct Taxes (CBDT) and the ruling of the Hon'ble Supreme Court in the case of CIT, Delhi v. Bharti Cellular Ltd. [2010) (193 Taxman 97).

4. That on the facts and circumstances of the case and in law, the Ld. TP/AO/DRP have erred in rejecting the Weighted Average Cost of Capital (WACC) assumption undertaken by an independent expert valuer and for this purpose,

a. questioned the methodology adopted by the expert, independent of any influence by the company

b. concluded that the expert's methodology is incorrect without any economic or legal rationale and/or reference to comparable data,

c. cherry picked while relying on 'expert data' for rejecting WACC assumptions while ignoring the data presented by the same international experts, relied upon by the Appellant to support its analysis

5. That on the facts and circumstances of the case and in law, the Ld TPO/AO/DRP have not taken cognizance of the fact that Reserve Bank of India (HB) has permitted the impugned transaction basis the same valuation report

6. That on the facts and circumstance of the case and in law, the Ld TPO/AO/DRP have violated arm's length principle by proposing to revise the valuation exercise by using actual results following the transfer date period vis-a-vis projections used by the company.

a. Without prejudice to the above, the actual results were duly furnished by the Appellant before DRP and no adjustment shall sustain using the same given actual sales being lower than projections used for valuation.

7. That on the facts and circumstances of the case and in law, the Ld. TPO/AO/DRP have erred in determining the sale price of specified assets transferred to its Associated Enterprise ("AE") (non-Indian assets) equivalent to the purchase price of all intangibles (Indian and non-Indian) acquired from a third party (Wipro Limited). In the process, TPO/AO/DRP have determined the value of intangibles retained by Appellant for its India business as zero.

Grounds against addition proposed in relation to availing of support services

8. That on the facts and circumstances of the case and in law, the Ld. AO/TPO/DRP have erred on facts and in law by not considering the detailed documentation and evidence submitted by the Appellant to demonstrate the fact that services were actually received by the Appellant for the purpose of its business.

9. That on the facts and circumstances of the case and in law, the Ld. AO/TPO/DRP have erred in questioning the commercial expediency of the Appellant and questioning whether the same have resulted in any tangible benefit received.

10. Without prejudice to the same, on the facts and circumstances of the case and in law, the Ld. AOTPO/DRP have erred by only making presumptions, without regard to the data submitted, in order to conclude that no tangible or direct benefit was derived by the Appellant from receipt of the intra-group services.

11. That on the facts and circumstances of the case and in law, the TPO/AO/DRP have failed to determine arm's length value of the transaction using prescribed rules and method and has instead determined the Arm's Length Price ("ALP") of support services availed at NIL without reference to any comparable data/circumstances.

12. That on the facts and circumstances of the case and in law, the TPO/AO/DRP have ignored to evaluate separate benchmarking of this international transaction already carried out by Appellant.

Grounds against addition proposed in relation to receipt of Research and Development ("R&D") fee

13. That on the facts and circumstances of the case and in law, the TPO/AO/DRP have erred in law and on facts in disregarding the search process adopted by the appellant and selecting / rejecting companies based on inappropriate and unreasonable criteria.

14. That on the facts and circumstances of the case and in law, net margins of certain Comparable companies appear to have been wrongly computed by the Ld. TPO when Compared with Annual reports of these companies. The Appellant has not been able to verify the reasons for variation in absence of back up computation from office of Ld. TPO.

15. That on the facts and circumstances of the case and in law, the TPO has failed to make appropriate adjustments to account for differences in working capital employed by the Appellant vis-à-vis the comparables despite specific directions by DRP.

Grounds against addition proposed W.r.t purchase of Security and Surveillance goods

16. That on the facts and circumstances of the case and in law, the Ld. TPO/AO/DRP has misconstrued the functional profile of the Appellant and has thereby erred in selecting Transaction Net Margin Method ("TNMM") as the Most Appropriate Method ("MAM") to benchmark the impugned international transaction instead of Resale Price Method ("RPM", which was more suitable in the case.

17. Without prejudice to any of the grounds, while applying TNMM as the MAM, the TPO/AO/DRP have grossly erred in facts and in law while computing the net operating margin earned by the Appellant by:

a. Not excluding Costs and results pertaining to EcoEnergy division, which is completely unrelated to the transaction/business being benchmarked

b. Not excluding intra-group services already treated as NIL by the TPO

c. Not treating Liabilities no longer required written back as operating in nature

d. Not treating Miscellaneous income as operating in nature

18. Without prejudice to any of the grounds, the TPO/AO/DRP have failed to take cognizance of the fact that losses incurred by the company are on account of business exigencies and appropriate adjustments need to be made for the same while applying TNMM.

19. Without prejudice to any of the grounds, the TPO/AO/DRP have erred in law and on facts in disregarding the search process adopted by the Appellant and selecting / rejecting companies based on inappropriate and unreasonable criteria.

20. That on the facts and circumstances of the case and in law, net margins of certain Comparable companies appear to have been wrongly computed by the Ld. TPO/AO/DRP when compared with Annual reports of these companies. The Appellant has not been able to verify the reasons for variation in absence of back up computation from office of Ld. TPO.

21. Without prejudice to any of the grounds, the TPO/AO have failed to make appropriate adjustments to account for differences in working capital employed by the Appellant vis-â-vis the comparables despite specific direction by the DRP.

22. Ld. AO has erred in incorrectly computing demand by not allowing set off of unabsorbed depreciation.

23. Ld. AO has erred in initiating penalty proceedings under Section 270A.”

10. The assessee also filed clarificatory/supplementary ground of appeal under rule 11 of the ITAT Rules, 1963, the same is reproduced below:

"24. Impugned order is time barred as no valid reference appears to have been made to the Ld. Transfer Pricing Officer ("TPO”) as prescribed under section 92CA of the Act."

11. At the time of hearing, ld. AR submitted as under :-

1. Present synopsis, being filed behalf of the Appellant, may kindly be considered in addition to material already placed on appeal record.

2. Chubb Alba Control Systems Private Limited (‘Appellant’) is now renamed as Ecoenergy Insights Limited and is engaged in the business of providing integrated security solutions since 1989 in India. Appellant is engaged in import of electronic security equipment/systems from its group companies for purpose of resale in Indian market. On 01.03.2017 Chubb Alba acquired “Ecoenergy” - Wipro Limited’s, energy services business division. Business transfer agreement dated 30.11.2016 was entered into for acquisition of same on a slump sale basis. This was an event of earlier assessment year.

3. During current Assessment Year 2018-19 major portion of acquisition relating to business outside of India was transferred to Automated Logic Corporation (‘ALC’) pursuant to agreement dated 25.01.2018.

4. Transfer pricing study undertaken by the Appellant is placed at page 29 of paper book. Summary details of international transaction benchmarked can be seen at page 36 of paper book.

Proceedings before Ld. Transfer Pricing Officer (‘TPO’)

5. Copy of Ld. TPO’s order dated 30.07.2021 can be found at page 2 of Appeal set. Ld. TPO mentioned that reference was received from AOTechnical Unit. It is respectfully submitted that under section 144B effective 01.04.2021, National E-assessment Unit/National Faceless Assessment Unit consists of various units. Assessment Unit and Technical Unit are defined and perform roles assigned under the Act. Technical unit is defined to provide specialist services like valuation and transfer pricing etc. Assessment unit coordinates completion of assessment in an electronic/ faceless manner. As such reference made by AO-Technical Unit does not qualify as a reference by AO as contemplated under section 92CA. Consequently, the reference appears to be invalid, and the transfer pricing and subsequent proceedings also appear to be time barred. In this context it is necessary to make following submissions – (a) time barring being a mandate to the forum, Hon’ble Tribunal may have to decide this preliminary aspect (b) assuming time barring aspect is decided in favour of Appellant, no further opportunities can be given to Revenue authorities by exercising power of remand for one reason or other as it is a settled principle the Hon’ble Courts cannot extend statutory time limits ( 2013) 10 SCC 765 Popat Bahiru Govardhane and Ors. Vs. Special land acquisition officer and another – para 16).

6. Profit and loss account can be found at page 3 of paper book. Revenue from operations during year under consideration was INR 148.54 crores. Schedule 20 on page 17 of paper book, gives the breakup – traded goods INR 52.93 crores, AMC 84.75 crores, R&D 1.34 crores and subvention received 9.51 crores.

7. Without prejudice to above, TPO made an adjustment to arm’s length price of four transactions viz., purchase of electric security equipment/systems; transfer of specified assets; availing of support services; AND receipt of R&D fee. The controversy involved in connection with each of these transactions which is the subject matter of present appeal is briefly detailed in the following paragraphs:

a) Purchase of electric security equipment/systems – Ground nos. 16 to 21: Reference to page 57 of paper book shows that during AY 18-19 goods worth INR 8.25 crores were imported. Detailed FAR is discussed in pages 58 to 60 of said TP Study. Basis for choosing Resale price method (RPM) can be found at pages 67 to 71 where at it is concluded that in comparison to 6 companies selected for benchmarking, this international transactions are at arm’s length. Detailed written submission filed in response to show cause notice is at page 663 to 682 of paper book – same are not being repeated in interest of brevity.

Kind reference is invited to relevant portion of Ld. TPO order at page 3 of Appeal Set. Detailed response filed by Appellant is extracted in TP order from pages 10 to 24 of Appeal Set. Ld. TPO summarised objections on page 24 but rejected RPM as Most appropriate method (MAM) and adopted TNMM at entity level for benchmarking this transaction overruling Appellant’s objections. Reference to page 26 (just above para 6.2) would show that RPM was rejected on a wrong notion that impact of AMC etc., also needed to be taken into account for margin analysis. Further reference to computation of adjustment at para 7 on pages 33 and 34 of TP order would show that international transaction cost is 4.08% of operating cost. However, basis flawed analysis adjustment of INR 2.56 crores is recommended by TPO.

Detailed objections filed before Dispute Resolution Panel (DRP) can be found from page 174 to 197 of Appeal set. In DRP order discussion starts at para 3.5 on page 215 of Appeal set, however, cryptic non-speaking finding of DRP can be found at para 3.5.2 on page 217 of Appeal set.

Relevant extract of DRP Order reads as follows:-

“3.5.2 The Panel has considered the submission. The arguments made here are just repetition of the contention raised before the TPO. It is noticed that the TPO has given adequate reasons his TP order for accepting RPM which he has reiterated in para 6.2 of his order. He has also spelt out detailed reasons for exclusion of Costs pertaining to EcoEnergy division acquired during the year from Wipro. Thus, Panel finds no reason to interfere with the order of the TPO. The TPO, however, shall grant working capital adjustment, if relevant data and detailed working were given to him during TP proceedings. Even in the remand report, the TPO has rightly intimated no worthwhile evidence has been furnished on any count.”

b) Transfer of specified assets – Ground nos. 3 to 7: Kind reference is invited to page 63 of paper book for background of the transaction. Economic analysis carried out by Appellant can be found from page 92 to 96 of paper book. Kind reference to pages 699 to 700 of paper book would show further submissions made before Ld. TPO in response to SCN. Independent valuers report and clause of audited financial statements referred in this context are also part of the paper book. Submission dated 23 July 2021 placed at pages 795 to 822 of paper book would also be relevant in the context.

Ld. TPO’s order discusses this issue at page 34 of Appeal set (para 8 of TP order). TPO issued SCN proposing to ignore the valuation based on estimated future revenue and proposed to substitute in actual revenue figures. After extracting the detailed response to SCN from pages 34 to 40, Ld. TPO disagreed with the same at para 9 on page 40 of Appeal set. Ld. TPO presumed that out of the acquired business Indian portion retained by Appellant has not value accordingly, ALP was determined considering the entire acquisition price as sale price and an adjustment of INR 39 crores is recommended.

In this context approach of Ld. TPO appears to be directly contrary to principles laid down by Hon’ble Jurisdictional High court in case of Principal Commissioner of Income -Tax Vs Cinestaan Entertainment Pvt Limited [2021] 433 ITR 82 – kindly refer placitum 13 on internal page 93 of said decision. Relevant extract of same is as follows:

“From the aforesaid extract of the impugned order, it becomes clear that the learned Income-tax Appellate Tribunal has followed the dicta of the hon'ble Supreme Court in matters relating to the commercial prudence of an assessee relating to valuation of an asset. The law requires determination of the fair market value as per prescribed methodology……… Since the performance did not match the projections, the Revenue sought to challenge the valuation, on that footing. This approach lacks material foundation and is irrational since the valuation is intrinsically based on the projections which can be affected by various factors. We cannot lose sight of the fact that the valuer makes forecast or approximation, based on the potential value of business. However, the underlying facts and assumptions can undergo change over a period of time. The courts have repeatedly held that valuation is not an exact science, and therefore cannot be done with arithmetic precision………”

Detailed objections were filed before DRP, same are placed at pages 98 to 121 of Appeal set. DRP concluded at page 210 para 3.2.3 that approach of TPO to modify the valuation made at time of acquisition by substituting actual revenue figures was correct. DRP also upheld Ld. TPO’s arbitrary substitution of technical parameters like WACC (weighted average capital cost) without any speaking order. Approach adopted by TPO and upheld by DRP is directly contrary to series of decisions of various Court cited in the written submissions but the same are conveniently and completely ignored to come to opposite conclusion.

c) Availing of support services - Grounds nos. 8 to 12: Circumstances in which such services were availed for continuity of business transactions is explained at para 4.3 and 4.4 on pages 61 and 62 of Transfer pricing study.

It was explained that without such services Appellant was in no position to continue the acquired business. Economic analysis carried out in connection with this transaction can be found at page 74 (para 5.2) to page 86 (Para 5.3.5) of paper book. It will kindly be noticed that Appellant chose foreign AE as tested party and TNMM as MAM. Identified comparable companies and established that transactions are at arm’s length.

After routinely noting Appellant’s detailed submissions Ld. TPO arbitrarily declared value of services at NIL, kind reference is invited to para 15 on page 70 of TP order in Appeal set. ALP of entire expenditure of INR 26.74 crores was determined to be NIL.

Detailed objections were filed before DRP which can be seen at pages 122 to 158 of appeal set. DRP notes the submissions from page 211 para 3.3.1 of DRP order in appeal set but arbitrarily upholds the view of TPO at para 3.3.2 and 3.3.4 on pages 212 & 213 by a non-speaking order.

Relevant extract of DRP Order reads as follows:-

3.3.2 The Panel has considered the submission. It is noticed that the arguments taken before the Panel have already been deals with by the TPO. The Panel agrees with the view of the TPO that in order to examine the arm’s length price of intra group services received by one of the associated enterprises following essential information should be available:

1. Whether the assessee has received intra group services?

2. What are the economic and commercial benefits derived by the recipient of intra group services?

3. In order to identify the charges relating to services, there should be a mechanism in place which can identify (i) the cost incurred by the AE in providing the intra group services and (ii) the basis of allocation of cost to various AEs.

4. Whether a comparable independent enterprise would have paid for the services incomparable circumstances”

“3.3.4 Thus, the TPO has rightly concluded that the assessee could not show that the above-mentioned criteria were fulfilled. The taxpayer has not been able to show as to when and how the various services were requisitioned from the AEs, whether the services were actually needed by it, whether the same were actually received by it by producing contemporaneous documentary evidence, at the time of entering into agreement or at the time of availing the services (if actually availed) what benchmarking analysis was done. In an arm’s length situation, before availing any service, an independent person would consider the nature of services required by it and would make the payment which commensurate with the nature of the service and the expected benefit derived there from. The facts of the case clearly show that whether or not the taxpayer needed these services or whether or not such services were mainly for it direct benefit or whether or not such services were actually availed by it, the taxpayer has to share the costs on the basis of some allocation keys. No independent person in similar circumstances would pay such amount. These are clearly shareholder services, without any basis other than the fact that the taxpayer is part of a group, and these expenses have been allocated to it. The Panel, therefore, upholds these findings of the TPO. Ever, in the remand report, the TPO has recorded that the additional evidence do not demonstrate any cost benefit analysis or any economic or commercial benefits. The Panel, therefore, finds no reasons to interfere with the order of the TPO.”

d) Receipt of R&D fee – Grounds nos. 13 to 16: Details of services rendered by Appellant are set out at para 4.6 of Transfer Pricing Study at pages 63 and 64 of paper book. Appellant is remunerated at cost plus 11 per cent. Considering the nature of services software development companies were considered as comparable – please see para 5.7.3 on page 98 of paper book. 16 companies were selected as comparable – please see page 102 of paper book.

Ld. TPO misunderstood the nature of services involved by placing over emphasis on the label given to services by Appellant and without appreciating true nature of the services involve rejected the approach of Appellant and substituted it with search from R&D service companies, leading to completely flawed conclusions and made adjustment of INR 8,82,671 to ALP – refer page 45 of Appeal set. Background working of search carried out and margin working of this new set proposed by TPO were not even made available to appellant.

After noting summary of submissions at page 214 para 3.4.1 Ld. DRP accepted the approach of TPO without giving any reasons, as can be seen from para 3.4.2 on page 214 of Appeal set.

Relevant extract of DRP Order reads as follows:-

“3.4.2 The Panel has considered the submission. The TPO has considered these contentions which are raised before the Panel. He has rejected the assessee’s benchmarking because the set of comparables taken by the assessee is similar to the set of comparables taken by the assessee for benchmarking of Provision for Software services. Further on Perusal of the Business Description of the comparables it is observed chat the company comparables taken by the assessee belongs to the software industry and, thus, cannot be accepted for benchmarking the Transaction of R&D Services. He accordingly conducted a fresh search or ACE TP and Prowess to benchmark the provision of R&D services. He has explained in para 3.2 of his order that he considered the following filters besides the accepted one to zero-in on final set of comparables for selecting suitable and functionally similar comparables to that of the tested party so as to benchmark the international transaction. The Panel is of the view that the benchmarking has been done correctly and no interference is called for. The TPO, however, shall grant working capital adjustment, if relevant data and detailed working were given to him during TP proceedings. The TPO did not find anything relevant in the set of additional evidence in his remand report.”

e) In above context it may be noticed that in case of purchase of electric equipment/ systems and R& D fees though DRP directed to grant working capital adjustment, Ld. TPO did not grant the same on alibi that DRP order directs grant of working capital adjustment only in case details of working capital were provided during TP proceedings – kindly refer page 220 of appeal set for order giving effect passed in this connection. Such an approach makes a mockery of the entire transfer pricing and DRP process.

Relevant extract from Order dated 21.07.2022 is as follows:-

“On the perusal of the TP record, the assessee has not submitted or claim any working capital adjustment during the TP proceedings, Since, the assessee has not submit any details during proceedings, therefore, working capital adjustment is not allowed on the issue of Purchased of goods as per the DRP directions.”

“On the perusal of the TP record, the assessee has not submitted or claim any working capital adjustment during the TP proceedings, Since, the assessee has not submit any details during proceedings, therefore, working capital adjustment is not allowed on the issue of Receipt of R&D fee as per the DRP directions.”

8. In above circumstances, Appellant humbly prays for deletion of Transfer pricing additions made to ALP towards above discussed 4 transactions. It is settled principle the appeals are not filed to grant one more opportunity when all relevant material was available for consideration of authorities and the authorities deliberately chose to disagree with the same. Secondly, it would be placing premium on abdication of responsibility and allowing the authorities to benefit from their own errors in not carrying out complete and objective analysis by a speaking order. Therefore, Appellant prays for final and complete deletion of such adhoc & casual additions made in the garb of TP proceedings.

Submitted for kind consideration.”

12. On the other hand, ld. DR submitted as under :-

“With reference to the above-captioned matter, it is respectfully submitted that the assessee, in their written submission dated 9th January 2025, has raised a new issue under Point No. 5. The issue pertains to the contention that the reference to the Transfer Pricing Officer (TPO) was made by the Technical Unit (TU) and, therefore, does not qualify as a valid reference under Section 92CA of the Income Tax Act, 1961.

Objection to the New Issue Raised

1. Procedural Lapse :

This ground was neither raised before the Dispute Resolution Panel (DRP) nor included in the original Grounds of Appeal (GOA).

Raising such a new issue/ground at this stage is contrary to established appellate procedures and disrupts the orderly conduct of proceedings.

2. Validity of Reference to TPO:

The contention raised by the assessee is factually incorrect. In the order of the TPO, it is clearly mentioned that the reference was made by the AO-Technical Unit.

Furthermore, the order of the AO in Para 5 explicitly states that the reference to the TPO was forwarded only after obtaining prior approval from the competent authority, ensuring the reference is valid under Section 92CA.

SOP Prevalent During the TP Reference

At the time of the Transfer Pricing (TP) reference, the SOP dated 19.11.2020 was in effect. This SOP outlines the procedure for sending references to the Technical Unit (TU),

Relevant references from the SOP include:

Para J ("Sending Reference to TU"):

Point 5: It is mentioned that technical assistance may be sought in the determination of the Arm's Length Price (ALP).

Under this provision, the Assessment Unit (AU) is authorized to seek the assistance of the designated TU for the determination of ALP The details of international transactions or domestic transactions between two or more associated enterprises must be specified by the AU to the TU through the National E-Assessment Centre in the prescribed format.

The TU, in turn, must request the TPO to determine the ALP in case of international transactions (as per Section 92B) or specified domestic transactions (as per Section 92BA) between associated enterprises, following the extant instructions.

This procedure demonstrates that the reference made by the AU, via the TU, to the TPO was consistent with the guidelines issued in the SOP dated 19.11.2020.

Additional SOP Reference (03.08.2022):

Subsequent to the SOP dated 19.11.2020, the SOP dated 03.08.2022 provided further detailed guidelines for the functioning of various units. Specific references include:

Para D.1.1: Responsibility of the TU for handling transfer pricing references.

Para D.3: Procedure for forwarding references to the TPO,

Para F2: Requirement for the TU to ensure proper handling of references received from the AU.

Para F.3: Timeline of 2-3 days for forwarding references to the TPO.

Para F.4: Mandate for forwarding the TPO's order to the AU within two days of receipt.

These provisions reaffirm the validity and procedural compliance of the TP reference in the present case.

In light of the above, the objection raised by the assessee in their written submission dated 9th January 2025 is both procedurally improper and factually untenable. The reference to the TPO was made in strict compliance with the SOP and relevant provisions of the Income Tax Act.

It is respectfully prayed that this issue raised by the assessee be dismissed outright as an afterthought, and the proceedings may be carried forward without considering this incorrect contention.

Since no new details or arguments apart from the above have been brought forward by the counsel that substantiate their claim, the undersigned relies on the findings and observations contained in the orders of the TPO, DRP &AO with respect to the other points raised by the counsel.”

13. Considered the rival submissions and material placed on record. We shall deal with the issues raised by the assessee ground-wise. Ground no.1 is general in nature and with regard to2 and 24, which are on the issue of final assessment order was passed by the AU instead of NFAC and impugned order is time barred as no valid reference made to the TPO. In this regard, we observe that this issue is elaborately discussed by the coordinate Bench in ITA No.3945/Del/2024 for AY 2020-21 dated 30.05.2025 in UCWEB Mobile Pvt.Ltd. and for the sake of brevity, the relevant findings are reproduced below :-

“Ground No. 1 is in relation to the limitation as according to assessee, the reference made to the TPO was not in accordance with law.

6. Before us, ld.AR of the assessee submitted that the order is barred by limitation as reference made to TPO was invalid. He drew our attention to the order of TPO wherein in First para of the order, the TPO observed that reference was received from AO-Technical Unit for determining the ‘Arm’s Length Price’ u/s 92CA(3) in respect to the International transactions entered into by the assessee. He further submits that as per section 144B of the Act, there is no provision that Technical Unit can make reference to TPO, as Technical Unit itself is authorised to perform functions of providing technical assistance on transfer pricing issues and itself is a Technical Unit. Thus, delegation by one Technical Unit under faceless regime to TPO is not permissible as per the provisions of Act. Under these circumstances, ld. AR submits that extended period of limitation u/s 153(4) of the Act of Twelve months (12 months) would not be available in absence of valid reference to TPO. He thus prayed that the order being barred by limitation and therefore, deserves to be quashed.

7. Per contra, the ld. CIT DR submits that under faceless assessment regime, there is no difference between the AO who completed the assessment and AO technical unit and both are functioning to complete / assists the assessment proceedings. According to ld. CIT DR, there is no error in making reference to the TPO by the AO-Technical Unit who assisted the AO - Assessment unit on technical issues to complete the assessment and in this process, has made reference to TPO for determination of arm’s length price of international transactions. Thus, the consequent proceedings are not barred by limitations and he prayed accordingly.

8. After careful consideration of the facts and arguments of both the parties, to decide this issue, we first examine the provisions of section 92CA(1) of the Act which are as under: 92CA. Reference to Transfer Pricing Officer

(1) Where any person, being the assessee, has entered into an international transaction or specified domestic transaction in any previous year, and the Assessing Officer considers it necessary or expedient so to do, he may, with the previous approval of the Principal Commissioner or Commissioner, refer the computation of the arm's length price in relation to the said international transaction or specified domestic transaction under section 92C to the Transfer Pricing Officer.

(10) …….….

Explanation.—For the purposes of this section, "Transfer Pricing Officer" means a Joint Commissioner or Deputy Commissioner or Assistant Commissioner authorised by the Board to perform all or any of the functions of an Assessing Officer specified in sections 92C and 92D in respect of any person or class of persons.

9. Sub-section (3) of section 144B of the Act, provides the scope and role of various units under faceless assessment such as National Faceless Assessment Centre (NFAC), Regional Faceless Assessment Centres, Assessment Units (AU), Verification Units (VU), Technical Units (TU) and Review Unit (RU). The relevant role of Technical Units (TU) as defined in clause (v) of sub-section (3) of section 144B is as under

(v) technical units, as it may deem necessary to facilitate the conduct of faceless assessment, to perform the function of providing technical assistance which includes any assistance or advice on legal, accounting, forensic, information technology, valuation, transfer pricing, data analytics, management or any other technical matter which may be required in a particular case or a class of cases, under this section;

10. Section 92CA(1) of the Act empowers the Assessing Officer to make reference to TPO for the computation of arm's length price of international transactions. Further, the TPO as defined in explanation to section 92CA to be the person authorized by board to perform functions of AO specified in section 92C. In sub-section 3 of section 144B, roles of Technical unit is clearly spelt out according to which, functions of technical unit includes assistance or advice on transfer pricing issues. During the course of performing such function, the technical unit can obtain advice from the TPO on the issue of determination of Arm’s Length price of international transaction as they are expert in this field. Thus, the reference by technical unit to TPO is in accordance with the provisions of the Act and therefore, consequent orders passed are not barred by limitations. Accordingly, Ground of appeal No. 1 of the assessee is dismissed.”

14. Against this order dated 30.05.2025, the assessee filed misc. application which was also dismissed by the coordinate Bench vide order dated in MA No.183/Del/2025 dated 06.08.2025 and the relevant extract of the order is reproduced below:-

“3. Heard the contentions of both parties and perused the material available on record. From the perusal of record, we find that during the course of hearing, Ld.AR of the assessee made submission on Ground of appeal No.1 taken with regard to jurisdiction and thereafter, proceeded to argue on the merits of the case. From the records, it is seen that the assessee has not withdrawn Ground No.1. Moreover, in the written synopsis filed before us, a brief submission is made in respect of Ground of appeal No.1 taken by the assessee which reads as under:-

GROUND NO. 1: ASSESSMENT TIME BARRED IN ABSENCE OF VALID REFERENCE ΤΟ ΤΡΟ

7. “Impugned order is barred by limitation as reference made to TPO is invalid. Extended period of limitation under section 153(4) of the Act of 12 months would not be available in absence of valid reference to TPO.

8. Jurisdiction invoked to conduct faceless assessment under section 144 B by issuance of section 143(2) notice can only be transferred to jurisdictional AO by following prescription under section 144B(8). Further section 1448 details functions of Assessment Unit, Technical unit, Verification Unit and Review Unit (section 1448(3)]. Section 130 facilitates concurrent jurisdiction for faceless assessment officers. Careful consideration of section 1448 would show that there is no provision for Technical Unit to make reference to TPO, as Technical Unit itself is authorised to perform functions of providing technical assistance for transfer pricing. Further delegation by one TPO (Technical Unit under faceless regime) to TPO (erstwhile physical assessment regime) is not permissible on a plain reading of provisions of Act.

9. Appellant bona fide believes that it would succeed on this jurisdictional challenge itself. However, since repeated adjournments were being taken by Respondent-Department on pretext of obtaining inputs from field offices in relation to technical ground (kindly refer to order sheets dated 16.01.2025 and 05.03.2025) solely in the interest of expediting consideration of its Appeal, Appellant is also making submissions on all the grounds of appeal relating to merits. Appellant prays for consideration of all grounds including jurisdictional ground as briefly mentioned above and in the event Hon'ble Tribunal grants relief on grounds relating to merit, Appellant prays that it may kindly be permitted to reserve its right to contest above technical ground before appropriate forums, should the need arise at later stages of litigation/future date.”

4. Since this Ground of appeal is not withdrawn by the assessee and submissions were also put forth therefore, adjudication of ground of appeal is not an error. Further, it is also is to be kept in mind that while passing the order, every ground of appeal should be considered and disposed off which has been done in the instant case and if any ground is left unanswered, there might be a situation where the assessee/ Revenue file MA for adjudication of the same. Thus, we find no error in the order of the Co-ordinate Bench in ITA No.3945/Del/2024 for AY 202-021 accordingly, M.A filed by the assessee is dismissed.

5. In the result, M.A. filed by the assessee is dismissed.”

15. Respectfully following the aforesaid decision of coordinate Bench, we dismiss ground nos. 2 and 24 raised by the assessee.

16. With regard to Ground Nos.3 to 7 which relate to issue of transfer of specified assets by the assessee, the relevant facts of the grounds raised by the assessee are, during assessment proceedings, the TPO observed that assessee has determined the value for development technology, trade name and goodwill on which assessee has estimated the revenue for the year 2007 onwards. The TPO asked the assessee to submit the actual figures for AYs 2017 to 2020 in order to compare the same with the estimations of revenue by the assessee for the purpose of valuation for the purpose of transfer of specified assets. The TPO further observed that for the purpose of weighted average cost of capital, the valuer adopted equity risk premium of 6% and additional risk premium of 6%. In response, assessee submitted the background of case. As per which during FY 2017-18, the post-acquisition of Ecoenergy Division from Wipro Limited in previous FY i.e. 2016-17, Chubb Alba had transferred certain intangibles to its Associate Enterprises (AE) i.e. Automated Logic Corporation (ALC) who in turn transferred the same to courier corporation as a part of group global TP development and ownership strategy. Further it was submitted that during the relevant period, Chubb Alba assigned certain economic rights and economic liabilities with respect to non-India customer contracts to ALC. A copy of the agreement was filed before the TPO. It was submitted that Chubb Alba acquired Ecoenergy business for a purchase consideration of US$ 70 million. The Board Resolutions were also submitted along with audited financials for the period. Chubb Alba transferred specified intangibles (developed technology, trade name and goodwill) to ALC for a consideration of US$ 68 million to ALC (Rs.387.27 crores). The transfer and assignment of Non-Indian customer contracts to ALC along with its economic rights/obligations and economic liabilities relating to such non- Indian customer contract for a consideration of US $ 3.2 million to ALC i.e. Rs.20.8 crores. Therefore, the total consideration for such transfer to specified intangible assets as well as Non-Indian customer contract was valued at US $ 64 million. It was further submitted that the above said valuation of transfer of US $ 64 million is the same valuation at which Ecoenergy business was acquired by Chubb Alba from Wipro Limited. The said purchase consideration is further supported by the valuation report undertaken by an external consultant already placed on record. Further TPO’s attention was drawn to Note No.4 of Audited Financial Statement of the assessee. Since the TPO has asked the assessee to submit the projected sales with actual sales assessee filed the objections to the same and relied on various case laws on this issue. Further TPO raised the issue of weighted average of cost of capital adopted by the independent valuer, assessee submitted the objections on the same and submitted that the valuation was obtained from an independent valuation expert, therefore, it cannot be questioned. After considering the above, the TPO proceeded to reject the projections adopted by the assessee as per the valuation report and also rejected the cost of risk premiums adopted by the valuer. Accordingly, he proceeded to propose the ALP adjustment u/s 92CA as under: -

|

Purchase value Wipro Ltd. |

70 million USD |

|

Arm’s length price (as calculated above) |

70 million USD |

|

Price charged by Assessee/ transfer price |

64 million USD |

|

Adjustment u/s 92CA (in USD) |

6 million USD |

|

Adjustment u/s 92CA (in INR) |

39,00,60,000 |

17. Aggrieved with the above order, assessee raised objections before the ld. DRP and also filed detailed submissions. After considering the detailed submissions, ld. DRP sustained the ALP adjustment proposed by the TPO with the observation that assessee did not provide the actual sales value inspite of specifically being asked for. It was also observed that the abovesaid financial projections were provided by the management only. With regard to additional risk premium, he observed that in the valuation report, additional risk premium was considered by the consultant for which the assessee has subjected only justification that the consultant has considered the market risk premium based on his understating. The ld. DRP observed that the valuation of such a big transaction cannot be done only on the whims and fancies of a particular consultant. There may be sufficient reasoning for before choosing a particulars value. Even though TPO has asked the assessee to substantiate the said claim, however there was deliberate withholding of relevant details from the TPO which prevented him to verify the methodology used for transfer of assets. Accordingly, he dismissed the objections raised by the assessee.

18. Aggrieved with the above order, assessee is in appeal before us.

19. At the time of hearing, ld. AR of the assessee invited our attention to page 63 of the paper book for bringing to our knowledge background of the transfer. Further he brought to our notice that assessee has carried out economic analysis which is placed at pages 92 to 96 of the paper book. He also brought to our notice independent valuer report and various clauses of audited financial statements relevant for the issue under consideration. Further he brought to our notice the submissions made before TPO and DRP. Further he brought to our notice page 34 of the appeal set and specific reference to para 8 of the TPO order. He submitted that TPO had ignored the valuation based on estimated future revenue and the objections raised by the assessee to substitute the same with actual revenue figures. In this regard, he brought to our notice Hon’ble jurisdictional High Court decision in the case of PCIT vs. Cinestaan Entertainment Pvt. Ltd. (2011) 433 ITR 82. Further he submitted that detailed objections were filed before the ld. DRP, however ld. DRP concluded in favour of TPO to modify the valuation made at the time of acquisition by substituting the actual revenue figures as correct and also upheld the arbitrary substitution of technical parameters like weighted average, cost of capital for favour of the TPO. Further ld. DRP ignored various decisions of various courts. He relied on the submissions made before the DRP.

20. On the other hand, ld. DR of the Revenue relied on the findings of DRP/AO.

21. Considered the rival submissions and material available on record. We observe that the TPO has replaced the projected figures while estimating the valuation of the specified assets with actuals and also objected to the additional risk of cost of capital adopted by the valuer while completing the valuation of the specified assets. We observe that assessee has valued the specified assets while acquiring the assets in the previous assessment year and the acquisition of the business was completed with Board Resolution and also acquiring valuation from a third party expert, the same was adopted in their books of account and also declared specific notes of account to the financial statements. In the current assessment year, the AO observed that assessee has partially transferred certain specified assets to its AE particularly transfer and assignment of Non- Indian customer contracts to ALC along with its economic rights, obligation and economic liabilities. It is relevant to note that valuation and acquisition of business was completed during previous assessment year and assessee has adopted the same valuation to transfer the specified assets during the year under consideration. During previous assessment year, assessee has adopted the same valuation to transfer the specified assets during the year under consideration and the TPO tried to replace the estimated/projected figures with actual figures and also questioned the methodology adopted by the independent valuer. In this regard, we observe that Hon’ble Delhi High Court in the case of Cinestaan Entertainment Pvt. Ltd. (supra) had held as under: -

"From the aforesaid extract of the impugned order, it becomes clear that the Learned Income -tax Appellate Tribunal has followed the dicta of the Hon'ble supreme Court in matters relating to the commercial prudence of an assessee relating to valuation of an asset. The law requires determination of the fair market value as per prescribed methodology... ... .... Since the performance did not match the projections, the revenue sought to challenge the valuation, on that footing. This approach lacks material foundation and is irrational since the valuation is intrinsically based on the projections which can be affected by various factors. We cannot lose sight of the fact that the valuer makes forecast or approximation, based on the potential value of business. However, the underlying facts and assumptions can undergo change over a period of time. They have repeatedly held that valuation is not an exact science, and therefore cannot be done with arithmetic precision,,,,,,,,,,,,,,,"

22. It is clear from the above decision of Hon’ble jurisdictional High Court that at the time of assessment, the officer cannot match actual performance with projections, therefore, this approach lacks material foundation and is irrational since the valuation is intrinsically based on the projections which can be affected by various factors. It was held that valuer makes forecost or approximation, based on the potential valuation of the business. Therefore, in our considered view, consistently the Hon’ble Courts have held that the AO cannot rework the projections at the time of assessment by replacing the projections with actuals. Therefore, we are inclined to allow ground nos.3 to 7 raised by the assessee in this regard.

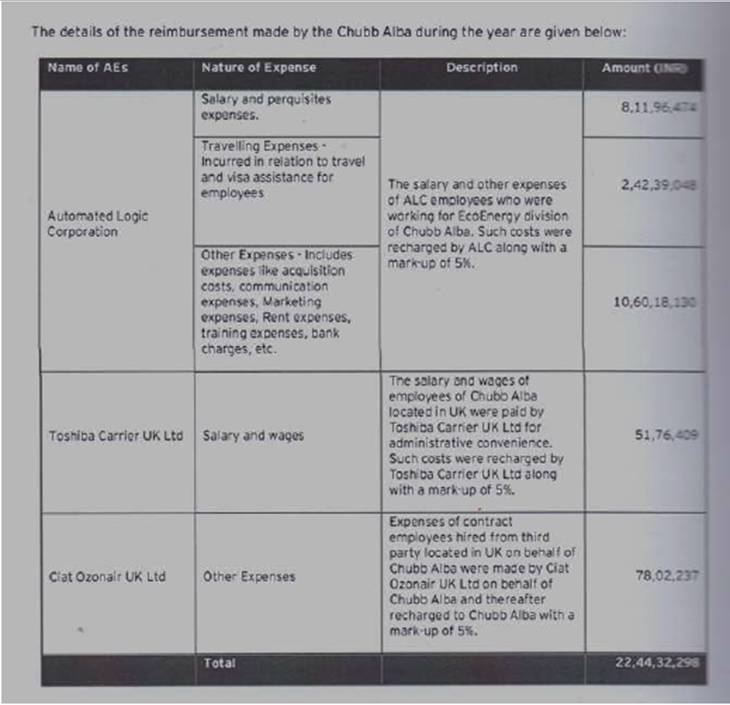

23. With regard to Ground Nos.8 to 12, the relevant facts are, Chubb Alba (assessee) had taken over business from Wipro Limited, the company had employees and contract workers in USA and UK catering onsite to the clients in this jurisdiction. Post-takeover assessee had no means to process their pay roll and associated cost in these countries. Therefore, the group companies situated in these countries were requested to assist assessee in processing salary and related expenses for such employees. Accordingly, during the impugned year, the ALC, TCUK and Ciat Oz (other AE’s) incurred payroll and certain other third party expenses on behalf of the assessee. Such costs were recharged by them to assessee on cost along with markup of 5%. The details of reimbursement made by assessee during the year were as under: -

24. During the year under consideration, assessee was granted certain projects on turn-key basis by third party customers. It executed around 25% of the project. However, due to challenges faced by it, also to reduce administrative challenges, balance projected was awarded to ALC services. The assessee had encashed the service charges independently with ALC on principle to principle basis. Accordingly, during the year under consideration, assessee had paid a sum of Rs.4,29,59,875/- to ALC services for the abovesaid services. After considering the TP study submitted by the assessee in which assessee had chosen foreign AEs as tested party and TNMM as MAM, also identified comparable companies and thereby it concluded that the transactions are at arm’s length. After considering the submissions of the assessee, the TPO observed that the assessee has failed to substantiate the services have actually been rendered to it and benefit has actually been availed by it on the basis of documentary evidence. Assessee has merely furnished copies of certain inter-company invoices raised and agreements entered into between the assessee and its AEs. After considering the documentations submitted by the assessee, he observed that it does not establish the requirements/specified notes of the assessee for their services, the benefit which has accrued to the assessee are that an independent party could have been willing to pay another independent party for the services purported to even received by the assessee. Further he observed that assessee has not provided the cost audit in relation to intra group services. He also rejected the contention of the assessee that the payment of intra group services is out of business exigency which cannot be questioned is based on wrong appreciation of transfer pricing provisions. Therefore, the TPO rejected the contentions of the assessee and treated the ALP of these prices as nil on application of CUP method as no uncontrolled enterprises would have paid any amount for such services which do not tantamount by intra group services with demonstrable benefits.

25. Aggrieved assessee has filed objections before the ld. DRP and filed detailed submissions before them. After considering the same, ld. DRP rejected the objections raised by the assessee by observing as under :-

“The Panel has considered the submission. It is noticed that the arguments taken before the Panel have already been deals with by the TPO. The Panel agrees with the view of the TPO that in order to examine the arm's length price of intra group services received by one of the associated enterprises following essential information should be available:

1. Whether the assessee has received intra group services?

2. What are the economic and commercial benefits derived by the recipient of intra group services?

3. In order to identify the charges relating to services, there should be a mechanism in place which can identify (i) the cost incurred by the AE in providing the intra group services and (ii) the basis of allocation of cost to various AEs.

4. Whether a comparable independent enterprise would have paid for the services incomparable circumstances"

"3.3.4 Thus, the TPO has rightly concluded that the assessee could not show that the above-mentioned criteria were fulfilled. The taxpayer has not been able to show as to when and how the various services were requisitioned from the AEs, whether the services were actually needed by it, whether the same were actually received by it by producing contemporaneous documentary evidence, at the time of entering into agreement or at the time of availing the service (if actually availed) what benchmarking analysis was done. In an arm's length situation, before availing any service, an independent person would consider the nature of services required by it and would make the payment which commensurate with the nature of the service and the expected benefit derived there from. The facts of the case clearly show that whether or not the taxpayer needed these services or whether or not such services were mainly for its direct benefit or whether or not such services were actually availed by it, the taxpayer had to share the costs on the basis of some allocation keys. No independent person in similar circumstances would pay such amount. These are clearly shareholders services, without any basis other than the fact that the taxpayer is part of a group, and these expenses have beer, allocated to it. The Panel, therefore, upholds these findings of the TPO. Ever, in the remand report, the TPO has recorded that the additional evidence do not demonstrate any cost benefit analysis or any economic or commercial benefits. The Panel, therefore, finds no reasons to interfere with the order of the TPO.”

26. Aggrieved assessee is in appeal before us.

27. At the time of hearing, ld. AR of the assessee submitted as under :-

“Circumstances in which such services were availed for continuity of business transactions is explained at para 4.3 and 4.4 on pages 61 and 62 of Transfer pricing study. It was explained that without such services Appellant was in no position to continue the acquired business. Economic analysis carried out in connection with this transaction can be found at page 74 (para 5.2) to page 86 (Para 5.3.5) of paper book. It will kindly be noticed that Appellant chose foreign AE as tested party and TNMM as MAM. Identified comparable companies and established that transactions are at arm's length.

After routinely noting Appellant's detailed submissions Ld. TPO arbitrarily declared value of services at NIL, kind reference is invited to para 15 on page 70 of TP order in Appeal set. ALP of entire expenditure of INR 26.74 crores was determined to be NIL.

Detailed objections were filed before DRP which can be seen at pages 122 to 158 of appeal set. DRP notes the submissions from page 211 para 3.3.1 of DRP order in appeal set but arbitrarily upholds the view of TPO at para 3.3.2 and 3.3.4 on pages 212 & 213 by a non-speaking order.”

28. On the other hand, ld. DR of the Revenue relied on the findings of the lower authorities.

29. Considered the rival submissions and material placed on record. We observe that assessee has availed certain services from its AE for implementation of turnkey projects on its behalf and assessee has submitted the TP study and economic analysis in the form of Paper Book before the TPO and ld. DRP. In the above said study, the assessee has treated foreign AE as tested party and adopted TNMM as MAM and also identified comparable companies and claimed that the transactions are at arm’s length. However, the TPO rejected the same and tried to establish the CUP method and rejected the TP study and most appropriate method adopted by the assessee. Further TPO/DRP has observed that assessee has not established the services and benefits availed by it by taking the services from its AE. They also observed that there was no mechanism in place which can identify the cost incurred by the AE’s in providing the intra-group services and also there was no basis of allocation of cost. After considering the material available on record, we observe that it is fact on record that assessee has availed certain services to implement certain turnkey projects outside India and in that process, assessee has availed certain services from its AE. From the material available on record, we observe that assessee has treated the AE as tested party and adopted TNMM method, however assessee has failed to submit the cost incurred by its AE and relevant allocation keys before the lower authorities. At the same time, we also observe that tax authorities have determined the ALP at Rs.nil. In our considered view, as per the submissions of the assessee, assessee has availed certain services from its AE, therefore, the ALP cannot be at nil. Therefore, we are inclined to remit this issue back to the file of Assessing Officer/TPO to determine the proper ALP by adopting the MAM and redo the ALP adjustment after giving proper opportunity of being heard to the assessee. At the same, time, we also direct the assessee to submit the relevant information relevant to determine the cost incurred by the AE and also relevant allocation of cost by various AEs before the Assessing Officer/TPO. Accordingly, these grounds raised by the assessee allowed for statistical purposes.

30. With regard to Ground Nos.13 to 16, the relevant facts are, assessee has entered into R&D agreement dated 26 January 2018 with Carrier Corp under which assessee undertakes R&D activities in the field of BEMs. A summary of R&D services rendered by assessee under the said agreement is as follows :-

Optimization of energy consumption by operationalising insights gained from Eco Energy’s cloud based proprietary Saas platform.

Development of analytical algorithms and processes for energy consumption, comparables, and corrective actions;

Statistical modelling of asset/site level, weather impact analysis, clustering and benchmarking;

Interpretation and system integration of hardware such as sensors, sub-metering devices that help to collect energy related data from HY AC or BAS system;

Development or modelling of maintenance analytics and/or customer experience analytics; and

Processes that facilitate the implementation of energy management services and hardware such as sensors and sub-metering devices.

Assessee is remunerated at actual costs plus 11 percent mark-up for these services. The total amount received by assessee for provision of R&D services during FY 2017-18 is INR 1,34,33,968.

31. After considering the TP study submitted by the assessee by adopting TNMM as MAM and taking the assessee as tested party for the purpose of ALP determination, the TPO has rejected the same and applied filters. Based on the filters selected by the TPO, he rejected the 16 comparables selected by the assessee and TPO has selected new comparables and determined the ALP adjustment as under: -

|

S. No. |

Company Name |

OP/OC |

|

1 |

Albany Molecular Research Hyderabad Research Centre Pvt. Ltd. |

10.15 |

|

2 |

IGENOMIX India Pvt. Ltd. |

13.84 |

|

3 |

Development Environergy Services Ltd. |

15.52 |

|

4 |

IQVIA RDS (India) Pvt. Ltd. |

16.37 |

|

5 |

Aurigene Discovery Technologies Ltd. |

20.21 |

|

6 |

Syngene International Ltd. |

29.04 |

|

7 |

Raptim Research Ltd. |

35.48 |

|

8 |

Cliantha Research Ltd. |

38.35 |

|

|

|

OP/OC |

|

35th percentile |

3rd |

15.52 |

|

65th percentile |

6th |

29.04 |

|

Median |

18.29 |

|

The computation of the ALP by the TPO for the international transactions undertaken by the assessee is given as below: -

|

Operating Costs |

12103000 |

|

ALP at 18.29% |

14316639 |

|

Price Received |

13433968 |

|

Adjustment u/s 92CA |

882671 |

32. Aggrieved with the above order, assessee filed objections before the ld. DRP and filed detailed submissions. After considering the detailed submissions, ld. DRP sustained the ALP adjustment proposed by the TPO by observing as under: -

“3.4.2 The Panel has considered the submission. The TPO has considered these contentions which are raised before the Panel. He has rejected the assessee's benchmarking because the set of comparables taken by the assessee is similar to the set of comparables taken by the assessee for benchmarking of Provision for Software services. Further on Perusal of the Business Description of the comparables it is observed chat the company comparables taken by die assessee belongs to the software industry and, thus, cannot be accepted for benchmarking the Transaction of R&D Services. He accordingly conducted a fresh search on ACE TP and Prowess to benchmark the provision of R&D services. He has explained in para 3.2 of his order that he considered the following filters besides the accepted one to zero-in on final set of comparables for selecting suitable and functionally similar comparables to that of the tested party so as to benchmark the international transaction. The Panel is of the view that the benchmarking has been done correctly and no interreference is called for. The TPO, shall grant working capital adjustment, if relevant data and detailed working were given to him during TP proceedings. The TPO did not find anything relevant in the set of additional evidence in his remand report"

33. At the time of hearing, ld. AR of the assessee submitted as under :-

“Details of services rendered by Appellant are set out at para 4.6 of Transfer Pricing Study at pages 63 and 64 of paper book. Appellant is remunerated at cost plus 11 per cent. Considering the nature of services software development companies were considered as comparable- please see para 5.7.3 on page 98 of paper book. 16 companies were selected as comparable - please see page 102 of paper book.