Income Tax - Transfer Pricing, ICDS, Disallowance under Section 40(a)(ia) - The assessee company, which is primarily engaged in the business of production of key components and systems used in heat transfer, separation and fluid handling, entered into certain international transactions with its Associated Enterprises (AEs). The Transfer Pricing Officer (TPO) made an upward adjustment to the arm's length price of the international transactions relating to the export of traded spares to the AEs. The Assessing Officer(AO) also made additions to the total income of the assessee on account of ICDS adjustments and disallowance under Section 40(a)(ia) of the Income Tax Act - Whether the AO/TPO was correct in rejecting the Transactional Net Margin Method (TNMM) adopted by the assessee for benchmarking the international transaction of export of traded spares and instead applying the Cost Plus Method (CPM) using internal comparables - Following its previous orders in the assessee's own case, held that the AO/TPO was not correct in rejecting the TNMM method adopted by the assessee and applying the CPM method using internal comparables. The issue was covered in favor of the assessee in the previous orders and the Ld. CIT(A) was justified in deleting the addition made by the AO/TPO on this ground – The appeal of the Revenue is dismissed

Issue 2: Whether the AO was correct in making an addition under Section 40(a)(ia) of the Income Tax Act on account of the difference between the amount of disallowance as per the tax audit report and the actual amount disallowed by the assessee in the computation of income – HELD - The assessee had claimed deduction in respect of the amounts disallowed under Section 40 in the preceding year but allowable during the year under consideration, and the assessee had provided the necessary documentary evidence to substantiate its claim. Therefore, the Ld. CIT(A) was justified in deleting the addition made by the AO under Section 40(a)(ia) of the Income Tax Act.

Issue 3: Whether the AO was correct in making an addition on account of ICDS adjustments not disclosed by the assessee – HELD - The assessee had correctly disclosed the adjustment on account of ICDS and the Ld. CIT(A) had properly appreciated the facts and deleted the addition. Hence, the Ld. CIT(A) was justified in deleting the addition made by the AO on account of ICDS adjustments.

2025-VIL-1502-ITAT-PNE

IN THE INCOME TAX APPELLATE TRIBUNAL

PUNE

ITA No. 2270/PUN/2024

Assessment Year: 2018-19

Date of Hearing: 21.07.2025

Date of Pronouncement: 10.10.2025

ACIT, CIRCLE - 8, PUNE

Vs

M/s ALFA LAVAL INDIA PVT LTD

Assessee by: Shri Nikhil S Pathak

Department by: Shri Prakash L Pathade, CIT DR

BEFORE

SHRI R. K. PANDA, VICE PRESIDENT

MS. ASTHA CHANDRA, JUDICIAL MEMBER

ORDER

PER R.K. PANDA, VP:

This appeal filed by the Revenue is directed against the order dated 27.08.2024 of the Ld. CIT(A)-13, Pune relating to assessment year 2018-19.

2. Facts of the case, in brief, are that the assessee is a Private Limited Company primarily engaged in the business of production of key components and systems used in heat transfer, separation and fluid handling viz. Plate and spiral exchangers, separators, decanter centrifuges, filters and strainers, flow equipment etc. It filed its return of income on 27.11.2018 declaring taxable income of Rs.246,57,12,000/-. The return was processed u/s 143(1) of the Income Tax Act, 1961 (hereinafter referred to as ‘the Act’) on 16.10.2019 determining the total income of the assessee at Rs.247,08,48,210/- after making adjustments as per section 36(1)(va) of the Act. Subsequently, the case was selected for scrutiny under CASS for the following reasons:

“1. Deemed International Transactions

2. Large value of international transactions

3. Transactions with Company whose Registration has been Cancelled by MCA

4. Duty Drawback

5. Lower amount disallowed u/s 40(a)(ia) in ITR (Part A-OI) in comparison to audit report

6. Large “any other amount allowable as deduction” claimed in Schedule BP of return

7. Expenses incurred for Earning Exempt Income

8. Difference in ICDS adjustments reported in Form 3CD and ITR.”

3. Accordingly statutory notices u/s 143(2) and 142(1) of the Act were issued and served on the assessee in response to which the assessee filed the requisite details. Since the assessee has entered into certain international transactions, the Assessing Officer referred the matter to the Transfer Pricing Officer (TPO) for determining the Arm’s Length Price (ALP) of the international transactions. The TPO vide order dated 28.07.2021 passed u/s 92CA(3) of the Act proposed an upward adjustment of Rs.1,78,97,091/- to the international transactions relating to the export of traded spares to the Associated Enterprises (AEs). Subsequently the Assessing Officer completed the assessment u/s 143(3) r.w.s. 144C(3) r.w.s. 144B of the Act on 18.11.2021 determining the total income of the assessee at Rs.2,71,18,45,575/- after making the following adjustments:

|

i. |

T. P. Adjustment as per order u/s. 92CA(3) |

Rs.1,78,97,091/- |

|

ii. |

Short disallowance u/s. 40(a) |

Rs.1,11,75,451/- |

|

iii. |

ICDS Adjustment Not disclosed |

Rs.7,51,15,458/- |

|

iv. |

Disallowance u/s 14A |

Rs.11,37,098/- |

|

v. |

Liquidated damages written back |

Rs.2,02,56,631/- |

|

vi. |

Project Provision Costs written back |

Rs.36,87,805/- |

|

vii. |

Reversal of Provision for Doubtful Debts |

Rs.2,94,96,845/- |

|

viii. |

Disallowance of Information Technology service expenses |

Rs.8,22,30,986/- |

4. In appeal, the Ld. CIT(A) deleted the above additions.

5. Aggrieved with such order of the Ld. CIT(A), the Revenue is in appeal before the Tribunal by raising the following grounds:

1.1. On the facts and circumstances of the case and in law, the Ld. CIT(A) erred in holding that the domestic market segment and the export market segment were distinct and not comparable and thereby, the application of the cost-plus method adopted by the TPO was incorrect.

1.2. On the facts and circumstances of the case and in law, the Ld. CIT(A) erred in rejecting CPM as most appropriate method for benchmarking the transaction of 'export of traded spares', without taking cognizance of the categorical finding given by TPO in para 41 of his order that the assessee is engaged in re-sale of traded spares imported mainly from AEs & Deemed AEs and therefore benchmarking has to be based on gross profits.

1.3. On the facts and circumstances of the case and in law, the Ld. CIT(A) erred in rejecting CPM as most appropriate method for benchmarking the transaction of 'export of traded spares’, without taking cognizance of the categorical finding given by TPO in para 40 of his order that there is internal comparable available, in the shape of assessee's sales of traded spares in the domestic market. Given the fact, that such segmental computation of profitability is from within the assessee's own company / operations, there cannot be any problem in computing the gross profitability in respect of each of these segments with needed degree of reliability.

2.1 On the facts and circumstances of the case the Ld. CIT(A) erred in deleting the addition of Rs.1,11,75,451/- u/s. 40(a)(ia) of the Act without appreciating the fact that the auditor had disallowed the expenses on account of non-deduction of TDS which has been duly disallowed in the ITR for AY 2017-18 on account of non-deduction of TDS under provisions of section 40(a). Thus, the Ld. CIT(A) has deleted the disallowance without appreciating that these were actual expenses incurred during AY 2017-18 by the assessee and not the "provisions for expenses” on which TDS was not deducted.

2.2 On the facts and circumstances of the case the Ld. CIT(A) erred in not appreciating the fact that the assessee had also failed to furnish any documentary evidence that TDS was deducted during the AY 2018-19 and deposited on such expenses.

3. On the facts and circumstances of the case the Ld. CIT(A) erred in deleting the addition of Rs.7,51,15,458/- on account of ICDS Adjustment not disclosed by the assessee without appreciating the fact that all adjustments arising due to ICDS need to be considered in the computation of taxable income whereas the the assessee had failed to increase the profit on account of ICDS adjustment as reported by the auditor in Form 3CD. While doing so, the Ld. CIT(A) failed to consider that statement of adjustments owing to ICDS shall form part of the tax audit report & return of income and disclosure requirements as required in ICDS shall form part of the tax audit report.

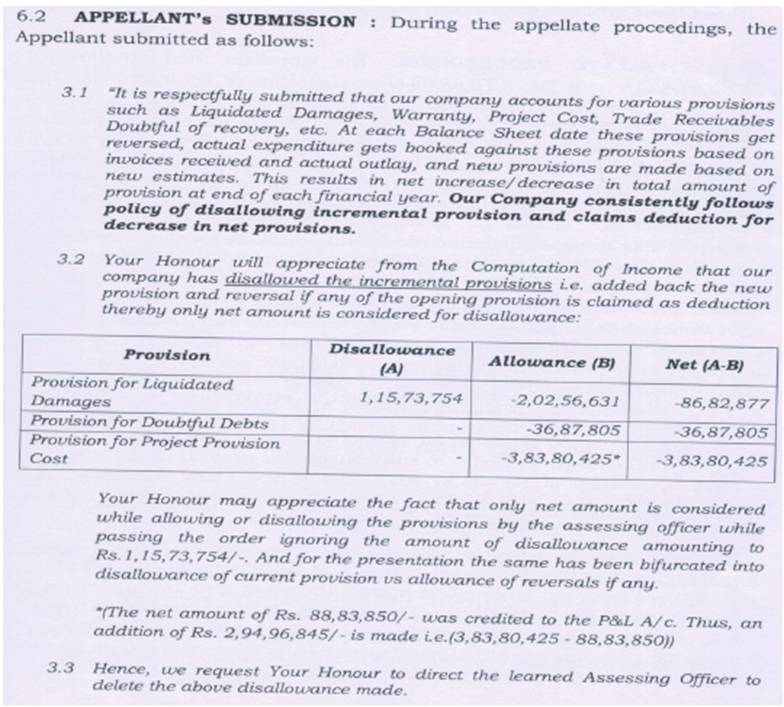

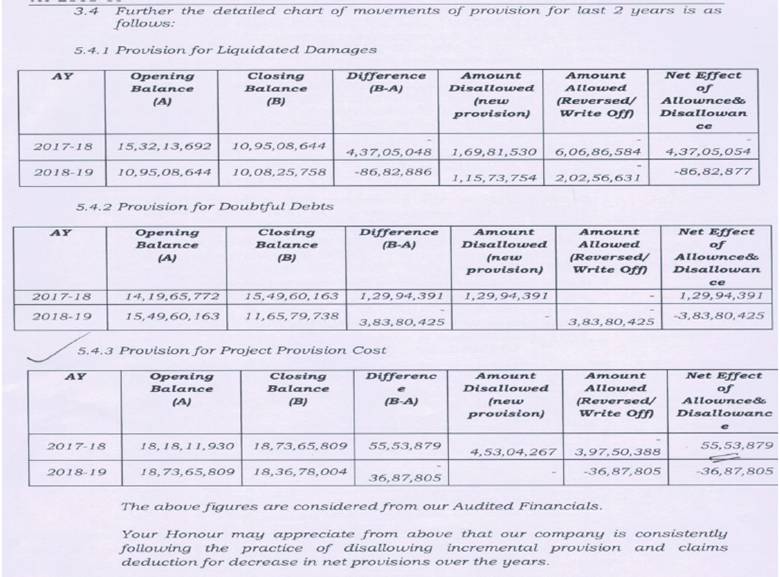

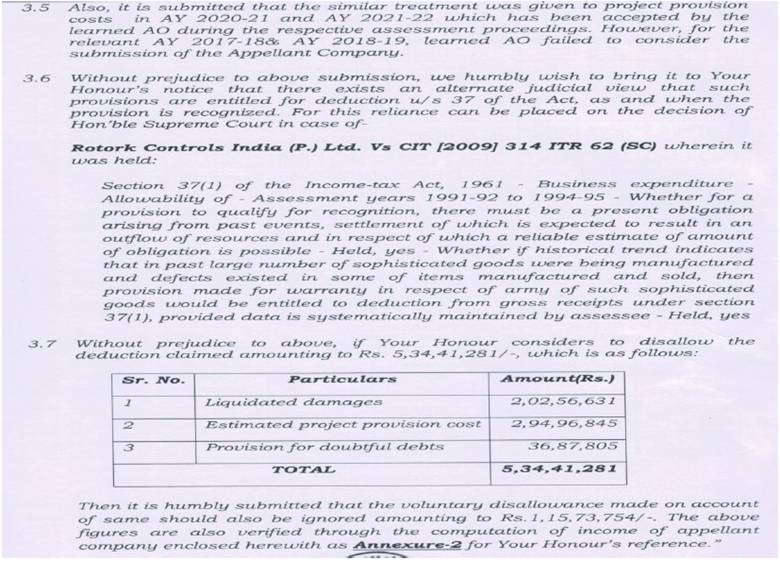

4.1 On the facts and circumstances of the case the Ld. CIT(A) erred in deleting the addition of Rs.2,02,56,631/- on account of disallowance of Liquidated damages written back, addition of Rs.36,87,805/- on account of disallowance of Project Provision Costs written back and of Rs.2,94,96,845/- on account of Reversal of Provision for Doubtful Debts without appreciating the fact that the assessee was required to first credit the written back liquidated damages / the Project Provision costs/provisions for doubtful debts to the P&L A/c before claiming the same as deduction from business income.

4.2 On the facts and circumstances of the case the Ld. CIT(A) erred in not appreciating the fact that as per the ITR, the assessee has not credited the written back liquidated damages / the Project Provision costs/provisions for doubtful debts, first to the P&L A/c, before deducting the same from business income in computation of total income.

4.3 On the facts and circumstances of the case the Ld. CIT(A) erred in not appreciating the fact that the assessce has failed to explain with documentary evidences as to how and where in the books of accounts, the actual current year provisions have been adjusted and net off with reversed provisions.

5. The appellant craves leave to add to, amend, alter any of the above grounds of appeal.

6. Ground Nos.1.1 to 1.3 relates to the order of the Ld. CIT(A) deleting the addition of Rs.1,78,97,091/- made by the Assessing Officer.

7. Facts of the case, in brief, are that the Assessing Officer observed that the assessee has entered into international transactions with its 'Associated Enterprises’ for which he referred the matter to the TPO for computation of the Arm's Length Price in relation to the international transactions entered into by the assessee. During the transfer pricing proceedings, the TPO observed that the assessee had entered into various international transactions with its AEs. He observed that the assessee company has adopted TNMM Method for benchmarking the international transaction of export of traded spares to the AEs. Further, the assessee company has selected 6 companies as comparable for trading activity. From the submissions filed by the assessee, the TPO noted that W R T Sales & Services Pvt. Ltd. is involved in Wholesale on a fee or contract basis. (Includes commission agents, commodity brokers and auctioneers and all other wholesalers who trade on behalf and on the account of others). W R T Sales & Services Pvt. Ltd. is into the distribution of Kirloskar Products and not into manufacturing. Hence he noted that both the companies i.e. ALIPL and WRT Sales & Services Pvt. Ltd. operate in totally diverse sectors without any basic comparison to their product lines. Considering this, he rejected the companies considered as comparable to the assessee company and method of benchmarking (i.e TNMM) was also rejected. The TPO considered CPM as the Most Appropriate Method while comparing internal comparables. Further, the TPO also observed that the export of manufactured equipment to AEs is at Rs.327.88 Crs as against the domestic sales at Rs.391.78 Crs. During the course of TP proceedings, he asked the assessee company to submit segmental details in respect of various segments of the assessee company with the working at the gross profit level. On verification of details submitted by the assessee, he noted that the gross profit over the cost in respect of the domestic segment is at 15.46% and that in case of export of manufactured equipments to AE's at 27.99%. Since the gross margins earned from exports to AE exceeded the gross margins from unrelated party sale, the TPO did not disturb the transaction prices for International transaction of equipment Division as recorded in books. He observed that the export of spares to AEs was at Rs.4.73 Crs as against the domestic sales of traded spares at Rs.101.28 Crs. He, therefore, issued a show cause notice to the assessee company to explain as per the queries. After considering the reply of the assessee company, the TPO worked out the value of the international transaction relating to the export of traded spares to the AE as under:

|

|

Particulars |

AE Exports |

Non AE Sales |

|

|

|

Rs. in Crs. |

Rs. in Crs. |

|

I |

Net Sales (As per Segmental PL) |

4,76,23,431 |

1,01,94,72,503 |

|

II |

Cost of goods sold |

2,72,00,747 |

42,32,32,489 |

|

|

GP / Costs |

75.08% |

140.88% |

|

III |

ALP Sales |

6,55,20,523 |

|

|

IV |

Adjustment required to the value of exports of traded spares (III-I) |

1,78,97,092 |

|

8. The Assessing Officer accordingly made addition of the same to the total income of the assessee.

9. Before the Ld. CIT(A) the assessee submitted that from assessment year 2008-09 till assessment year 2016-17 the issue stands decided in favour of the assessee holding that TNMM method was the most appropriate method to benchmark its international transaction of traded spares and internal comparison was not appropriate.

10. Based on the arguments advanced by the assessee the Ld. CIT(A) deleted the addition made by the Assessing Officer / TPO by observing as under:

“2.3 I have carefully considered the facts of the case and submission filed by the appellant. I agree with the appellant's contention that this issue is covered in appellant's favour by my learned predecessor's orders for AY 2014-15, AY 2015-16 & AY 2016-17 and also by Honourable ITAT Pune's orders for AY 2009-10, AY 2010-11 and AY 2011-12. The Honourable ITAT in the appellant's case for Assessment year 2009-10 and 2010-11 has accepted the submission of appellant company and held that TNMM was the most appropriate method to benchmark its international transaction of traded spares and internal comparison was not appropriate. The TNMM adopted by appellant company and comparing net operating margins of the respective segments with average of the net operating margins derived by the comparable companies is appropriate. Respectfully following such precedents, appeal on this ground is allowed.”

11. Aggrieved with such order of the Ld. CIT(A) the Revenue is in appeal before the Tribunal.

12. The Ld. DR heavily relied on the order of the TPO / Assessing Officer and the grounds raised by the Revenue on this issue.

13. The Ld. Counsel for the assessee on the other hand drew the attention of the Bench to the order of the Tribunal in assessee’s own case for the immediately preceding assessment year vide ITA No.1723/PUN/2024 order dated 29.04.2025 for assessment year 2017-18, copy of which is placed at pages 96 to 104 of the paper book. He submitted that identical issue has been decided by the Tribunal and the grounds raised by the Revenue on this issue have been dismissed. He accordingly submitted that the issue being covered in favour of the assessee, the grounds raised by the Revenue on this issue should be dismissed.

14. We have heard the rival arguments made by both the sides, perused the orders of the Assessing Officer and the Ld. CIT(A) and the paper book filed on behalf of the assessee. We have also considered the various decisions cited before us. We find the TPO in the instant case rejecting the TNMM method adopted by the assessee for benchmarking the international transaction of export of spares to the AEs adopted internal CPM method as the most appropriate method and made adjustment of Rs.1,78,97,091/- being the ALP of the international transactions. We find the Ld. CIT(A) following the orders of his predecessors for preceding years i.e. from assessment year 2014-15 to 2016-17 and the order of the Tribunal in assessee’s own case for assessment years 2009-10 to 2011-12 deleted the addition holding that TNMM method is the most appropriate method. The relevant observations of the Ld. CIT(A) have already been reproduced in the preceding paragraphs. We do not find any infirmity in the order of the Ld. CIT(A) on this issue. We find the Tribunal in assessee’s own case for the immediately preceding assessment year vide ITA No.1723/PUN/2024 order dated 29.04.2025 for assessment year 2017-18 at para 7 of the order has discussed this issue and dismissed the grounds raised by the Revenue by observing as under:

“7. We have heard the rival contentions and perused the record placed before us. The assessee which is a subsidiary of Alfa Laval AB, Sweden holds 98.20% equity stake in the assessee company during the year. Assessee is a leading supplier of plate and spiral exchangers, centrifugal separators and decanters, sanitary flow products etc. During the year under consideration it entered into various international transactions with its AE and the ALP was calculated applying Transactional Net Margin (TNMM) method. However, ld. TPO was of the view that Cost Plus method using internal comparables is the most appropriate method. Ld. TPO also observed that the assessee company has joint facility arrangement and a long term buy and supply arrangement through which a manufacturing facility has been created in India through which equipments are sold to the AE on a year on year basis and also in the domestic market. Since the goods manufactured in India are exported to AE as well as sold in the domestic market, ld. TPO was of the view that Cost Plus method is the most appropriate method for benchmarking the international transaction relating to export of equipments to AE. We further observe that ld. CIT(A) granted relief to the assessee following the decision of this Tribunal taken in assessee’s own case for past years. The latest one for A.Y. 2013-14 vide ITA No.1945/Pun/2017 order dated 20.06.2019 deals with the very same issue and this Tribunal has held that the claim of the assessee of adopting TNMM for calculating the ALP for the international transaction deserves to be allowed in light of the settled legal proposition in favour of the assessee and also observing that the comparison of profit margin of export market segment with that of domestic market segment is not proper. Thus, respectfully following the same, we hold that Cost Plus method adopted by the TPO deserves to be rejected and held to be unsustainable. Therefore no interference is called for in the finding of ld.CIT(A). Grounds of appeal No.1(a), (b), and (c) raised by the Revenue are dismissed.”

15. In absence of any contrary material brought to our notice by the Ld. DR on this issue, we do not find any infirmity in the order of the Ld. CIT(A) deleting the addition made by the Assessing Officer / TPO. Accordingly, the grounds raised by the Revenue on this issue are dismissed.

16. Ground No.2.1 to 2.2 raised by the Revenue relates to the order of the Ld. CIT(A) deleting the addition of Rs.1,11,75,451/- u/s 40(a) of the Act.

17. Facts of the case, in brief, are that during the course of assessment proceedings the Assessing Officer noted that as per the audit report in Form No.3CD filed for assessment year 2018-19 the assessee made total payment of Rs.4,29,41,308/- which were liable for disallowance @ 30% u/s 40(a)(ia) of the Act. Further, he noted that the assessee made payment of Rs.49,93,112/- to Non-residents without deduction of TDS which were liable for disallowance u/s 40(a)(ia) @ 100%. He noted that the assessee made total disallowance of Rs.1,78,75,505/- i.e. Rs.1,28,82,393/- being 30% of Rs.4,29,41,308/- u/s 40(a)(ia) of the Act and disallowance of Rs.49,93,112/- u/s 40(a)(i) of the Act in the ITR filed for assessment year 2018-19. However, in computation of total income the assessee made disallowance of Rs.67,00,054/- only instead of Rs.1,78,75,505/- u/s 40(a)(ia) of the Act. Thus, there was difference of Rs.1,11,75,451/-. He, therefore, confronted the same to the assessee.

18. The assessee submitted that the provision for expenses on which TDS was not deducted for earlier years was reversed against the actual expenditure booked during the year i.e. assessment year 2018-19. However, in absence of any documentary evidence filed by the assessee regarding the actual expenditure incurred against such provision during the assessment year 2018-19, the Assessing Officer rejected the contention of the assessee. He noted that these expenses are disallowed for non-deduction of TDS in assessment year 2017-18 as per assessee’s own submissions. He further noted from the audit report and ITR for assessment year 2017-18 that the auditor has disallowed these expenses on account of non-deduction of TDS which has been duly disallowed in the ITR on account of non-deduction of TDS under the provisions of section 40(a)(ia). The Assessing Officer, therefore, held that these were the actual expenses incurred during the assessment year 2017-18 and not the provision for expenses on which TDS was not deducted. Rejecting the various explanations given by the assessee the Assessing Officer made addition of Rs.1,11,75,451/- u/s 40(a)(ia) of the Act.

19. Before the Ld. CIT(A) it was submitted that the following amounts are disallowed under clause 21(b) of the Tax Audit Report for assessment year 2018-19:

|

Particulars |

Amount (Rs.) |

Disallowance |

|

40(a)(ia): Commission or Brokerage |

1,64,52,362 |

49,35,709 |

|

40(a)(ia) Payments to contractors or sub contractors |

1,79,916 |

53,975 |

|

40(a)(ia): Fees for professional or technical services |

2,63,09,030 |

78,92,709 |

|

40(a)(i): Sum payable outside India or to a Non-resident |

49,93,112 |

49,93,112 |

|

Total |

1,78,75,505 |

4,79,34,420 |

1.2 Above mentioned amounts referred to the provisions amounts / accrued expenses, hence disallowed under section 40(a)(i) and 40(a)(ia) under clause 21(b) of Tax Audit Report and the same is reflected in return of income under "Schedule BP: Computation of income from business or profession, Part A, Serial no.16" on page no.86 ……”

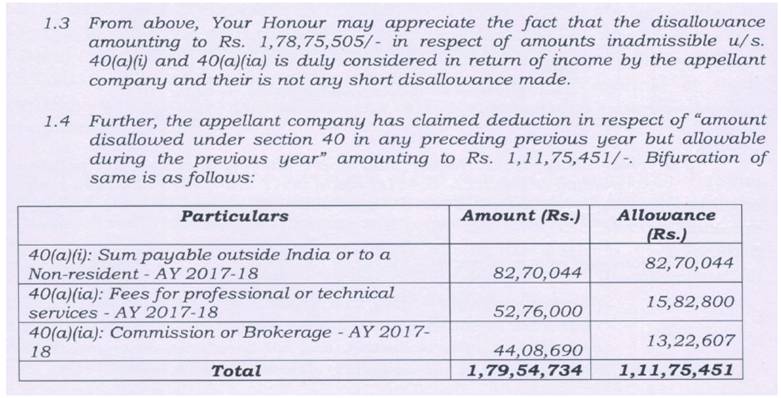

20. It was submitted that the assessee company has claimed deduction in respect of amounts disallowed u/s 40 in any preceding previous year but allowable during the previous year amounting to Rs.1,11,75,451/-, the bifurcation of which is as under:

21. It was submitted that the disallowance amounting to Rs.1,11,75,451/- made in assessment year 2017-18 has been claimed by the assessee in assessment year 2018-19. Referring to the provisions of section 40(a)(ia) it was submitted that the assessee has claimed the said deduction in accordance with provision of section 40(a)(ia). It was accordingly argued that the addition made by the Assessing Officer should be deleted.

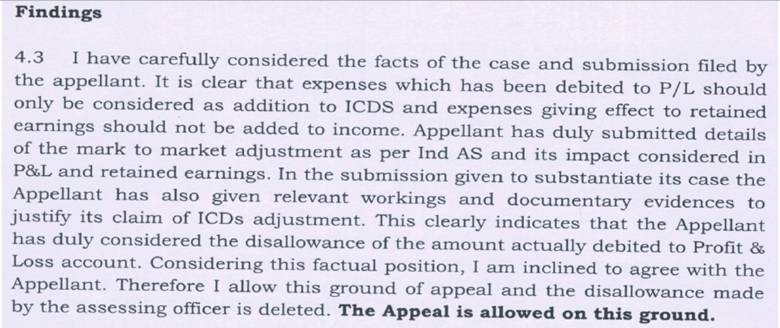

22. Based on the arguments advanced by the assessee the Ld. CIT(A) deleted the addition by observing as under:

“3.3 I have carefully considered the facts of the case and submission filed by the appellant. I agree with the appellant's contention that the disallowance u/s 40(a)(ia) claimed by appellant in AY 2018-2019 has been duly disallowed in AY 2017-2018. The Appellant submitted relevant details of reversal of these provisions along with copies of challans of TDS payment for expenses booked the subsequent years.

3.4 It is also seen that the provisions of the year end on which TDS has not been deducted have been subsequently reversed in the month of April and the expenses have been booked against the provision once the invoice from the party is received subsequently. Considering this factual position, I am inclined to agree with the Appellant accordingly I allow the claim of the Appellant on this ground. The Appeal is allowed on this ground.”

23. Aggrieved with such order of the Ld. CIT(A) the Revenue is in appeal before the Tribunal.

24. The Ld. DR submitted that the assessee claimed before Ld. CIT(A) that the provisions for expenses on which TDS was not deducted in earlier years, was reversed against the actual expenditure booked during the year i.e. AY 2018-19. However, the assessee has not furnished any documentary evidence regarding the actual expenditure incurred against such provisions during the year AY 2018-19 i.e. head of expenditure, party name, respective ledgers etc. He submitted that these expenses were disallowed for non-deduction of TDS in AY 2017-18 as per assessee's own submission. Further from the audit report and ITR filed for AY 2017-18 by the assessee it is seen that the auditor has disallowed these expenses on account of non-deduction of TDS which has been duly disallowed in the ITR on account of non-deduction of TDS under the provisions of section 40(a)(ia). He further submitted that from the books of account of the asssessee it was established that these were actual expenses incurred during AY 2017-18 and not the "provisions for expenses” on which TDS was not deducted. He submitted that the assessee failed to furnish any documentary evidence that TDS was deducted during the assessment year 2018-19 and deposited on such expenses. This was also mentioned in the draft assessment order. However, in response to the draft assessment order also, the assessee did not furnish any evidence of deducting and depositing TDS pertaining to the impugned expenses which disallowed earlier. He accordingly submitted that the order of Ld. CIT(A) be reversed and that of the Assessing Officer be restored.

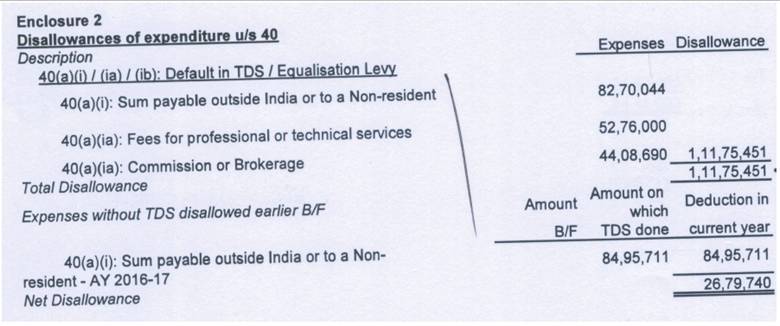

25. The Ld. Counsel for the assessee on the other hand drew the attention of the Bench to page 137 of the paper book which is the statement of income for assessment year 2017-18. Referring to the same he submitted that the assessee has suo motu disallowed an amount of Rs.26,79,740/- u/s 40(a)(ia) and claimed the other deduction as per Schedule 7 of Rs.21,40,57,292/-. Referring to page 139 of the paper book, which is the disallowance of expenditure u/s 40, the Ld. Counsel for the assessee drew the attention of the Bench to the following:

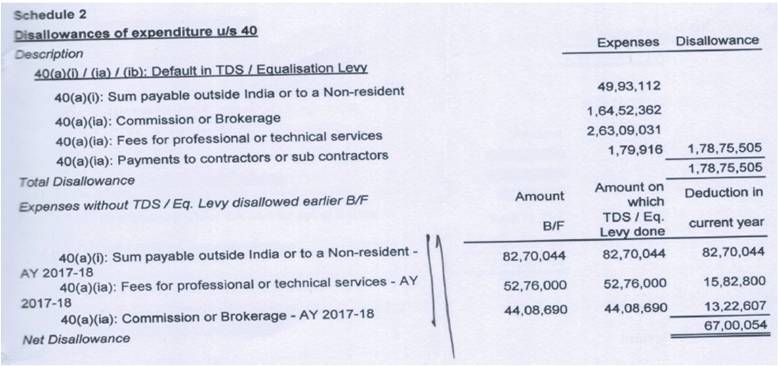

26. Referring to page 317 of the paper book the Ld. Counsel for the assessee drew the attention of the Bench to the statement of income for assessment year 2018-19. He submitted that the assessee has suo motu made disallowance of Rs.67,00,054/- u/s 40 and deducted an amount of Rs.62,90,80,715/- being the income considered separately as per Schedule 5. Referring to page 319 of the paper book the Ld. Counsel for the assessee drew the attention of the Bench to the disallowance of expenditure u/s 40, the details of which are as under:

27. Referring to page 32 of the paper book he submitted that since the order of the Ld. CIT(A) being in accordance with law, therefore, the same should be upheld and the grounds raised by the Revenue be dismissed.

28. We have heard the rival arguments made by both the sides, perused the orders of the Assessing Officer and the Ld. CIT(A) and the paper book filed on behalf of the assessee. We find the Assessing Officer in the instant case made addition of Rs.1,11,75,451/- on the ground that there is difference between the amount of disallowance u/s 40(a)(ia) as mentioned in the tax audit report and the actual amount disallowed by the assessee in the computation of income. We find the Ld. CIT(A) deleted the addition, the reasons of which have already been reproduced in the preceding paragraphs. We do not find any infirmity in the order of the Ld. CIT(A) on this issue. A perusal of the details furnished by the assessee shows that it had claimed deduction in respect of “amount disallowed u/s 40 in any preceding previous year but allowable during the previous year amounting to Rs.1,11,75,451/-” which has been disallowed in assessment year 2017-18 under the Schedule-BP. We further find the provisions of year end on which TDS has not been deducted have been subsequently reversed in the month of April and the expenses have been booked against the provision once the invoices were received from the party subsequently. Under these circumstances, we do not find any infirmity in the order of the Ld. CIT(A) on this issue. Accordingly, the grounds raised by the Revenue on this issue are dismissed.

29. Ground No.3 raised by the Revenue relates to the order of the Ld. CIT(A) deleting the addition of Rs.7,51,15,458/- on account of ICDS adjustment not disclosed by the assessee.

30. Facts of the case, in brief, are that during the previous year relating to assessment year 2018-19 the auditors in their Tax Audit Report in Form No.3CD has reported net increase of Rs.48,58,47,490/- on account of application of ICDS, the details of which are as under:

|

Description |

Increase in profit |

|

ICDS-VI-Changes in Foreign Exchange Rates |

11,93,60,516 |

|

ICDS-VIII-Securities |

36,64,86,974 |

31. He noted that in the return of income filed the assessee has shown net increase in the profit due to ICDS of Rs.41,90,75,017/- which is shown in ITR as “any other item or items of addition u/s 28 to 44DA” and the remaining amount of Rs.6,03,58,168/- is on account of amount directly credited to the retained earnings. The Assessing Officer, therefore, confronted the assessee to explain the discrepancy with detailed note. He also asked the assessee to submit the detailed computation of net increase in profit of Rs.48,58,47,490/- along with applicable ICDS.

32. It was submitted that the assessee had accounted Mark to Market gain / loss on forward contracts which were recorded for future assets / liabilities in the books of accounts as per the accounting policy followed by the company of Rs.6,44,01,765/- and Rs.5,49,58,751/- respectively. Accordingly, the impact of the same was considered for ICDS valuation totaling to Rs.11,93,60,516/- and out of the above, Rs.6,03,58,168/- has not been credited to Profit & Loss account and instead has been directly credited to Retained earnings. Since this amount has not been accounted through Profit & Loss account, the same has not been considered by the assessee company again in its computation of income. Therefore, there is difference of Rs.6,03,58,168/- in the amount added to total income in the computation of income and amount as shown in ICDS by the Tax auditor. It was further submitted that considering the effect of ICDS the assessee company has rightly added the Mark to Market loss for future assets / liabilities in its return of income. The amount considered by the Tax Auditor in the ICDS table of Rs.48 cr has been added back by the assessee company in the computation of income as well as ITR. It was submitted that in the computation of income, the net effect of Mark to Market gain and loss considered at Rs.35,01,90,088/- is a net result of Loss of Rs.36,64,86,974/- and gain of Rs.1,62,96,886/-. The assessee also filed the details substantiating that it has made addition to the net profit of Rs.41,90,75,017/- which has been disclosed as any other item added in the ITR and not just Rs.35,01,90,088/-.

33. However, the Assessing Officer was not satisfied with the arguments advanced by the assessee. According to him, since the company has directly credited the Retained Earnings in balance, the same has not been offered for tax while computing total income. Rejecting the various explanations given by the assessee, he made addition of Rs.7,51,15,458/- on account of ICDS adjustment not disclosed.

34. Before the Ld. CIT(A) it was submitted that the assessee during the year had accounted Mark to Market gain / loss on forward contracts which were recorded for future assets / liabilities in the books of account as per the accounting policy following by the assessee company. The assessee filed the following breakup:

|

31st March 2018 |

Investment |

Derivative |

|

March 17 MTM 31st Dec 16 |

733,235,303 |

60,358,168 |

|

March 17 MTM 31st Dec 17 |

99,924,315 |

(54,774,975) |

|

March 18 MTM |

(482,969,530) |

54,958,751 |

|

COI impact |

350,190,088 |

60,541,944 |

|

FX Gain other than Derivative MTM |

- |

(81,289,951) |

|

Realized Gain on sale of Invest. |

(629,080,715) |

- |

|

Gain As Per P&L |

278,890,627 |

20,748,007 |

35. It was accordingly argued that the addition made by the Assessing Officer is not correct.

36. Based on the arguments advanced by the assessee the Ld. CIT(A) deleted the addition by observing as under:

37. Aggrieved with such order of the Ld. CIT(A) the Revenue is in appeal before the Tribunal.

38. The Ld. DR submitted that the decision of the Ld. CIT(A) is not acceptable since all adjustments arising due to ICDS need to be considered in the computation of taxable income. He submitted that the statement of adjustments owing to ICDS shall form part of the tax audit report and return of income. Disclosure requirements as required in ICDS shall form part of the tax audit report. Referring to the assessment order he submitted that in computation of total income, the assessee effectively disclosed increase in profit on account of ICDS adjustment to the extent of Rs.41,07,32,032/- only. However, it failed to disclose the remaining amount of Rs.7,51,15,458/- (Rs.48,58,47,490 total increase reported by the auditor in 3CD minus 41,07,32,032 disclosed by the assessee in Col). He accordingly submitted that the order of the Ld. CIT(A) on this issue be reversed and that of the Assessing Officer be restored.

39. The Ld. Counsel for the assessee on the other hand drew the attention of the Bench to the tax audit report filed by the assessee which is placed at pages 288 to 316 of the paper book. Referring to the copy of income tax return for assessment year 2018-19 which is placed at pages 153 to 264 of the paper book he drew the attention of the Bench to page 237 and submitted that as per column No.23 the assessee has shown deemed income of Rs.41,90,75,017/- under ‘any other item or items of addition u/s 28 to 44DA. Referring to page 384 of the paper book the Ld. Counsel for the assessee drew the attention of the Bench to ICDS VI, Income Computation and Disclosure Standards (ICDS) and drew the attention of the Bench to para 8 of the said order which reads as under:

“8. (1) Any premium or discount arising at the inception of a forward exchange contract shall be amortised as expense or income over the life of the contract.

Exchange differences on such a contract shall be recognised as income or as expense in the previous year in which the exchange rates change. Any profit or loss arising on cancellation or renewal shall be recognised as income or as expense for the previous year.

(2) The provisions of sub-para (1) shall apply provided that the contract:

(a) is not intended for trading or speculation purposes; and

(b) is entered into to establish the amount of the reporting currency required or available at the settlement date of the transaction.

(3) The provisions of sub-para (1) shall not apply to the contract that is entered into to hedge the foreign currency risk of a firm commitment or a highly probable forecast transaction. For this purpose, firm commitment, shall not include assets and liabilities existing at the end of the previous year.

(4) The premium of discount that arises on the contract is measured by the difference between the exchange rate at the date of the inception of the contract and the forward rate specified in the contract. Exchange difference on the contract is the difference between :

(a) the foreign currency amount of the contract translated at the exchange rate at the last day of the previous year, or the settlement date where the transaction is settled during the previous year, and

(b) the same foreign currency amount translated at the date of inception of the contract or the last day of the immediately preceding previous year, whichever is later

(5) Premium, discount or exchange difference on contracts that are intended for trading or speculation purposes, or that are entered into to hedge the foreign currency risk of a firm commitment or a highly probable forecast transaction shall be recognised at the time of settlement.”

40. He submitted that as per the said provisions, Mark to Market gain or loss is relevant only in the books of account and for income tax purpose, it has to be ignored and only at the time of settlement it has to be considered. He submitted that the assessment year involved is assessment year 2018-19 and the provisions of ICDS are applicable to the assessee from assessment year 2017-18. Referring to the tax audit report for assessment year 2017-18, copy of which is placed at pages 265 to 287 of the paper book, the Ld. Counsel for the assessee drew the attention of the Bench to page 269 and submitted that the assessee has shown ICDS with changes in foreign exchange rates at Rs.6,59,41,361/-. Referring to page 137 of the paper book he submitted that the assessee for the assessment year 2017-18 has shown “other deduction” at Rs.21,40,57,292/- as per Schedule 7. Referring to page 140 of the paper book he drew the attention of the Bench to the impact of Indian Accounting Standard “MTM gain on forward contracts” at Rs.55,83,193/-. He submitted that an amount of Rs.6.03 crores has been directly taken to the Reserves. He submitted that the tax auditor has committed a mistake in assessment year 2017-18 which has been rectified in assessment year 2018-19. Referring to page 34 of the paper book the Ld. Counsel for the assessee drew the attention of the Bench to the disclosure of Rs.6,03,58,168/- being “fair valuation gain of forward contract” as on 01.01.2017 and has also disclosed related deferred tax liability of Rs.2,08,88,755/-. Referring to page 37 of the paper book he drew the attention of the Bench to the other income according to which net gain on sale of investment / change in fair value of investment was shown at Rs.27,88,90,627/- as on 31.03.2018. Referring to page 317 of the paper book he drew the attention of the Bench to the income considered separately at Rs.62,90,80,715/- as per Schedule 5. Referring to page 320 of the paper book he drew the attention of the Bench to Schedule 5 according to which the “income considered under other heads” i.e. capital gain was shown at Rs.62,90,80,715/-. He submitted that since the assessee has correctly disclosed the adjustment on account of ICDS and the Ld. CIT(A) after appreciating the facts properly has deleted the addition, therefore, the same being in order, the order of the Ld. CIT(A) should be upheld and the grounds raised by the Revenue on this issue should be dismissed.

41. We have heard the rival arguments made by both the sides, perused the orders of the Assessing Officer and the Ld. CIT(A) and the paper book filed on behalf of the assessee. We find the Assessing Officer in the instant case made addition of Rs.7,51,15,458/- being the income of the assessee on account of not disclosing the increase in profit due to ICDS adjustment as reported in audit report in Form No.3CD. We find the Ld. CIT(A) deleted the addition, the reasons of which have already been reproduced in the preceding paragraphs. We do not find any infirmity in the order of the Ld. CIT(A) on this issue. The assessee in the instant case has clearly demonstrated that it has correctly computed and disclosed the increase in profit in ICDS adjustment. The assessee before us also demonstrated by drawing our attention to the various disclosures made in the audited accounts and the computation statement. The Ld. DR could not controvert the details given by the assessee substantiating the adjustment as per Indian Accounting Standard, its impact, working and documentary evidences to justify its claim of ICDS adjustment. Therefore, in absence of any distinguishable features brought on record by the Ld. DR we do not find any infirmity in the order of the Ld. CIT(A) on this issue. Accordingly the same is upheld. The ground raised by the Revenue on this issue is accordingly dismissed.

42. Ground No.4.1 raised by the Revenue relates to the order of the Ld. CIT(A) deleting the addition of Rs.2,02,56,631/- on account of disallowance of liquidated damages written back, disallowance of project provision costs of Rs.36,87,805/- and reversal of provision for doubtful debts of Rs.2,94,96,845/-.

43. Before the Assessing Officer it was submitted that the assessee had disallowed Rs.1,69,81,530/- and Rs.8,76,65,984/- on account of liquidated damages in assessments years 2017-18 and 2015-16 respectively. These damages were disallowed under section 37 while computing income tax on Business Income. Since these expenses were disallowed in earlier years it could not be held liable for tax in the year under consideration when they are reversed and credited to Profit & Loss Account. Accordingly, the assessee took the deduction of Rs.2,02,56,631/- in the relevant year under any other amount allowable as deduction.

44. It was further submitted that during the year under consideration the assessee company disallowed the provision for doubtful debts in the past years i.e. assessment years 2017-18 and 2014-15 amounting to Rs.1,29,94,391/- and Rs.4,97,18,119/- respectively under any other disallowance. During the year under consideration, reversal of Provision for Doubtful Debts amounting to Rs.2,94,96,845/- were claimed as deduction as earlier offered to income.

45. It was further submitted that during the relevant year under consideration the assessee claimed deduction of Rs.36,87,805/- on account of provision for estimated projects costs warranty costs. In the assessment year 2017-18, the assessee company disallowed provision for estimated projects cost of Rs.4,53,04,267/- u/s 37 in ITR for assessment year 2017-18. In subsequent year i.e. year under consideration there is reversal of Rs.36,87,805/- out of the above disallowed opening provision. Therefore, the assessee company claimed deduction of the same as the same was already offered to tax in earlier years. It was submitted by the assessee that reversal of liquidated damages of Rs.2,02,56,631/-, provision for doubtful debts of Rs.2,94,96,845/- & project provision cost of Rs.36,87,805/- has been disallowed by the assessee company in earlier years when this provision was made in the books of accounts. These are yearly items of provisions in the nature of contingent which the assessee company disallows in return and reversal, if any, out of it is claimed subsequently.

46. However, the Assessing Officer was not satisfied with the submissions made by the assessee in absence of complete details to his satisfaction. According to him, the assessee has not provided any bifurcation of the amount added back in the computation under the head disallowance u/s 37 of Rs.12.73 crores for assessment year 2018-19 for which it was not possible to check whether the assessee has added back any amount related to the reversal of provision of liquidated damages in that account. Similarly in absence of any details of bad debts actually written off during the year the Assessing Officer was not satisfied with the submissions made by the assessee towards reversal of provisions for doubtful debts of Rs.2,94,96,845/-. So far as the provision for project costs disallowed earlier now written back at Rs.36,87,805/- is concerned, the same was also rejected by the Assessing Officer on the ground that the assessee has not provided any bifurcation. The Assessing Officer accordingly made addition of Rs.2,02,56,631/-, Rs.36,87,805/- and Rs.2,94,96,845/- respectively.

47. Before the Ld. CIT(A) the assessee made the following submissions:

48. Based on the arguments advanced by the assessee, the Ld. CIT(A) deleted the addition by observing as under:

“6.3 I have carefully considered the facts of the case and submission filed by the appellant. I agree with the appellant's contention that Appellant Company consistently follows policy of disallowing incremental provision and claims deduction for decrease in net provisions. Further, from verification of computation of income it is seen that the appellant company has disallowed the provisions of these expenses in earlier years. The Appellant has submitted that similar treatment was given to project provision costs, liquidated damages, doubtful debts in AY 2020-21 and AY 2021-22 which has been accepted by the learned AO, Assessment Unit, NFAC. Similarly it is accepted in earlier years also.

6.4 It can be seen that the Appellant has disallowed the provision made during the year. Similarly such provision made in earlier years has also been added back. In such case, the write back of such provision has to be allowed as a deduction. Considering this factual position, I am inclined to agree with the Appellant on these 3 grounds taken-up together. The Appeal is allowed on these grounds.”

49. Aggrieved with such order of the Ld. CIT(A) the Revenue is in appeal before the Tribunal.

50. We have heard the rival arguments made by both the sides, perused the orders of the Assessing Officer and the Ld. CIT(A) and the paper book filed on behalf of the assessee. The factual finding given by the Ld. CIT(A) that the assessee company is consistently following the policy of disallowing incremental provision and claims deduction for decrease in net provision, could not be controverted by the Ld. DR. Further, the Ld. CIT(A) also given a finding on verification of the computation of income that the assessee company has disallowed the provision of these expenses in earlier years. The Ld. DR could not bring any material to negate the factual finding given by the Ld. CIT(A). The finding of the Ld. CIT(A) that similar treatment was given to project provision costs, liquidated damages and provision for doubtful debts in assessment year 2021-22 which has been accepted by the Assessing Officer in the assessment order also could not be controverted by the Ld. DR. In view of the above and in view of the detailed factual finding given by the Ld. CIT(A) on this issue, we do not find any infirmity in the order of the Ld. CIT(A) on this issue. Accordingly the same is upheld and the ground No.4 raised by the Revenue is dismissed.

51. In the result, the appeal filed by the Revenue is dismissed.

Order pronounced in the open Court on 10th October, 2025.

DISCLAIMER: Though all efforts have been made to reproduce the order accurately and correctly however the access, usage and circulation is subject to the condition that publisher is not responsible/liable for any loss or damage caused to anyone due to any mistake/error/omissions.